Introduction

In light of the approval of the government’s manifesto and the vote of confidence in the government by the parliament on 21 November 2023, the Council for Budget Responsibility is required, under Article 4(1)(a) of constitutional Act No. 493/2011 Coll. on fiscal responsibility[1], to publish a special report on the long-term sustainability[2].

“The CBR prepares and publishes the long-term sustainability report, including the baseline scenario and determination of the long-term sustainability indicator, annually as of 30 April and always within 30 days of the parliamentary debate on the government’s manifesto and the vote of confidence in the government.”

Pursuant to §30aa of Act No. 523/2004 Coll. on the general government budgetary rules and on amendments to certain acts, as amended, the compiled baseline scenario for the development of public finances and the long-term sustainability indicator serve as the basis for calculating the new public expenditure ceiling for each year of the government’s term of office[3]. Expenditure ceilings represent a key budgetary instrument to ensure long-term sustainability of public finances, and are an essential operative tool of budgetary governance, thus supplementing the existing debt limit rules specified in constitutional Act No.493/2011 on fiscal responsibility. Public expenditure ceilings are calculated by the Council for Budget Responsibility and submitted to the National Council for discussion within 60 days following the approval of the government’s manifesto and vote of confidence in the government.

As opposed to regular reports on long-term sustainability published by the end of April every year, this special report focuses exclusively on presenting a baseline scenario of development in public finances for the next 50 years, serving as the basis for the first calculation of public expenditure ceilings after the general election. New expenditure ceilings are thus recalculated for the years 2024 to 2027 to fairly reflect the state of legislature in terms of public finances for the new government. In this special report, the main focus is on describing the developments in the general government balance over the medium-term until 2027, as this is the source of data needed to calculate the ceilings.

Under the current methodology for the calculation of expenditure ceilings[4], it is assumed that the CBR and the Ministry of Finance will cooperate in discussing the estimate of the scenario’s baseline year and the budgetary data, serving as the basis for the development of the general government balance in the horizon up to 2027. The resulting baseline scenario also takes into account the results of the discussions and the exchange of data between the CBR and the Ministry of Finance.

Procedure for the preparation of the baseline scenario

The baseline scenario for the development of general government revenue and expenditure[5] serves to set the planned value of structural balance[6], which is then used in the calculation of expenditure ceilings for individual years. Subsequently, the value of the long-term sustainability indicator specifies the current level of risk to public finances, on the basis of which an improvement in structural balance required[7] over the next years is determined. This provides a link between public expenditure ceilings and long-term sustainability of public finances.

The baseline scenario for the calculation of the public expenditure ceiling for years 2024 to 2027 is based on the Macroeconomic Forecasting Committee’s forecast of 8 November 2023 and the Tax Revenue Forecasting Committee’s forecast of 14 November 2023, reflecting the legislation in force at the time of the approval of the government's manifesto and the vote of confidence in the government on 21 November 2023.

The baseline scenario is based on the estimated development of public finances in 2023. The importance of a realistic baseline estimate of the balance is underlined by the fact that its level also affects the development in the structural balance in the medium-term (2024-2027). In accordance with the valid methodology, the estimate of the balance in the baseline year was discussed with the Ministry of Finance.

In the medium-term, the estimate reflects the valid methodology for the preparation of baseline scenario for regular reports on long-term sustainability, subject to specific adjustments (the differences from this procedure are described in Box 1).

Box 1: Differences in the baseline scenario methodology for calculating the public expenditure ceiling

A detailed description of the procedure for the preparation of the baseline scenario is provided in CBR’s Discussion Paper No. 2/2015 “Preparation of the baseline scenario for development of public finances”. Other changes (concerning, for instance, the transition to the ESA2010 methodology) have been described in the individual reports on long-term sustainability of public finances.

The differences between the preparation of the baseline scenario based on the estimate of the balance in 2023 and the procedure applied in the ex-post evaluation of the long-term sustainability indicator in CBR’s regular reports published annually by 30 April are as follows:

- Instead of the actual data published by the Statistical Office of the Slovak Republic, CBR uses its own estimate of the government revenue and expenditure based on input data from several sources (the Ministry of Finance, the Tax Revenue Forecasting Committee, the Macroeconomic Forecasting Committee, CBR) as the base year of the baseline scenario. The estimate also includes additional impacts and measures included in the state budget for 2023 beyond the framework of established rules for the indexation of individual items based on macroeconomic and demographic indicators, as well as legislative changes and other measures adopted before the approval of the government’s manifesto and the vote of confidence in the government (21 November 2023).

- Over the medium-term, the estimates of developments in government revenue and expenditure items are indexed by macroeconomic indicators taken from the Macroeconomic Forecasting Committee (MFC) forecast of 8 November 2023 (the CBR normally uses its own estimate of macroeconomic developments). The forecast was rated as realistic by all members of the committee.

- The estimates of government revenue and expenditure items projected by the Tax Revenue Forecasting Committee have been taken over in full from the Committee’s November forecast (for these items, the CBR normally uses its own estimates). This involves the medium-term forecast for most of the revenues from taxes and social contributions (TRFC), selected non-tax revenue and selected expenditure items. The Committee’s forecast was deemed realistic by all of its members when considering the endorsed MFC’s macroeconomic forecast.

- The estimates of the use of EU funds and the funds from the Recovery and Resilience Facility (RRF), including co-financing and VAT under RRF, were taken entirely from the Macroeconomic Forecasting Committee’s estimate (the CBR normally uses its own estimates of these items).

- The cyclical component of revenue and expenditure was estimated based on the average value of the output gap estimate by the MFC, CBR and the National Bank of Slovakia in November 2023 (the CBR normally uses its own estimate of the output gap).

- One-off effects are based on the CBR’s estimate and include government measures and other effects related to the pandemic, war in Ukraine and energy crisis. In the medium-term, the CBR used the estimate of one-off expenditures related to energy crisis and war in Ukraine from the documents provided by the Ministry of Finance (only for 2024, as the Ministry does not assume one-off effects in the subsequent years). The approach to identifying these one-off effects was identical as in a standard baseline scenario.

- A different approach is also used regarding capital expenditures. The baseline scenario used for the calculation of public expenditure ceilings is based on the estimate of investments funded from national sources for 2023. In subsequent years, this amount is indexed by the projected GDP growth rate without further adjustment. In the baseline scenario using the actual data, expenditure is also indexed by GDP growth rate, but instead of actual capital expenditure, it is based on a four-year average of investments, so that any volatility in investments does not likewise lead to sharp year-on-year changes in the long-term sustainability indicator.

- The debt interest payments are estimated in more detail over the medium-term using the ARDAL debt issue plan and are based on the completed issues of debt instruments up to the end of November 2023. Beyond the 2027 horizon, a simplified approach is applied, assuming an average debt maturity of ten years (because the only assumptions available are those for an average yield on ten-year government bonds), with one tenth of the total amount of debt becoming due each year. When scenarios are prepared in a standard manner, this simplified procedure is applied over the entire 50-year horizon.

Estimated general government balance in 2023

The estimate of the balance in 2023 is based on CBR’s most recent forecast prepared on the basis of ongoing fulfilment of the budget in terms of revenue and expenditure. The general government balance estimate under the ESA2010 methodology is mainly based on the data available in the reporting system of the Ministry of Finance and the State Treasury, capturing the cash-based fulfilment of the budget by general government entities, as well as on other inputs prepared on the basis of budget data, available reports for general government entities, new measures approved by the government and the parliament and expert estimates for selected areas of the budget[8].

Compared to the CBR’s forecast prepared and published at the end of November 2023, which expects a deficit of 7,310 mn euros (6.0 % of GDP), the estimate of the balance in 2023 has been adjusted as follows:

- In line with the methodology and following a discussion with the Ministry of Finance, the estimate reflects the Ministry’s assumptions for selected areas of the budget. In addition to items described in Box 1 (e.g., budget revenue and expenditure projected by the Tax Revenue Forecasting Committee, usage of funds from the EU and RRF), the CBR’s estimate has been aligned with the assumptions of the Ministry of Finance for the following budget revenues and expenditures:

- costs of policies related to the pandemic;

- transfer to the EU budget;

- accrual budgetary impact of the expenditure on military equipment;

- the impact of renewable energy subsidies (green energy);

- current expenditure in the fiscal performance of a public entity Železničná spoločnosť Slovensko (the Railway Company Slovakia, ŽSSK).

- The estimate excludes the effect of the special allowance for pensioners, the costs of which come in at 440 mn euros (0.4 % of GDP), because this is a measure adopted by the government after the approval of the government’s manifesto. In the CBR’s November forecast, which takes into account all measures relevant for the fulfilment of the budget irrespective of the date of their adoption, these expenditures were included in the estimated deficit.

- At the same time, the estimate also reflects new information unknown at the time of publication of the CBR’s November forecast. Based on the government document[9], the expected amount of refunds for energy compensations from EU funds has been updated. At the same time, the estimated expenditure in connection with permanent kurzarbeit has been revised downwards due to low uptake in the first nine months.

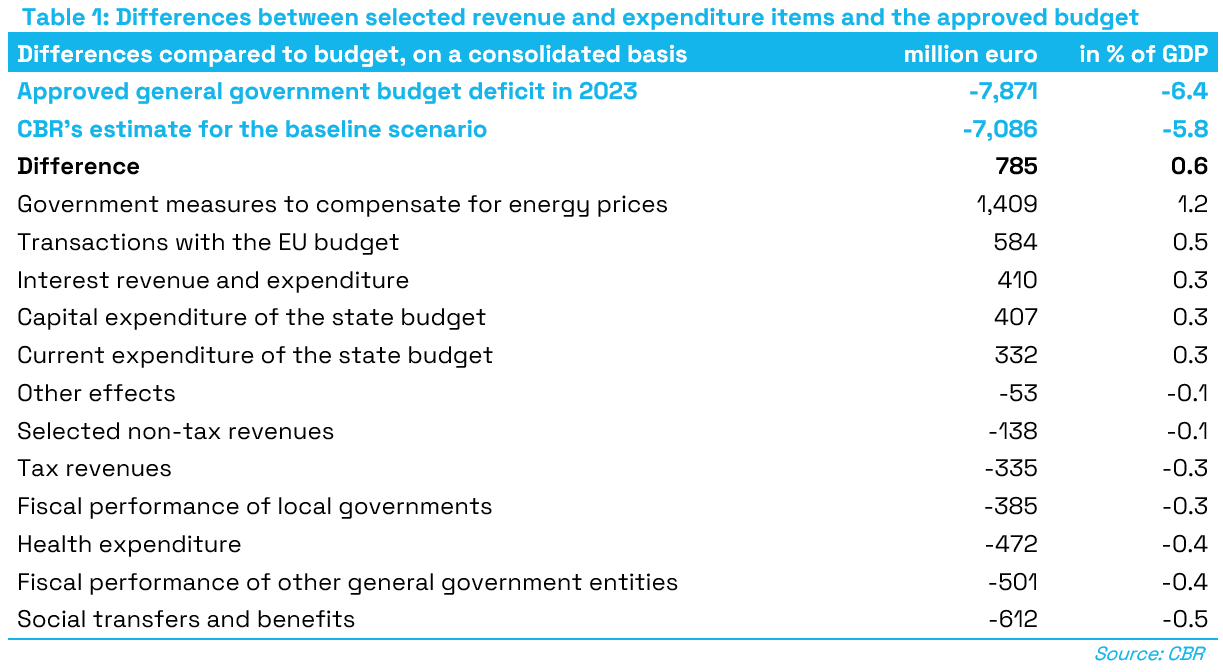

Given the assumptions stated above, the baseline scenario bases the estimate of general government deficit in 2023 at 7,086 mn euros (5.8 % of GDP). Compared to the general government budget approved for 2023, the deficit is lower by 785 mn euros (0.6 % of GDP), with the main differences summarised in Table 1. Compared to the estimate published by the Ministry of Finance in the budget proposal for 2024-2026, the difference is amounting to 862 mn euros (0.7 % of GDP).

The government’s measures related to the compensation of energy prices in 2023, including windfall revenues, improve the deficit by 1,409 mn euros compared to the budget. The most significant positive impact is due to the refunds of household energy expenditure from EU funds, which is estimated to total 1,033 mn euros[10]. Also, European market energy prices are lower than expected in the budget.

As far as transactions with the EU budget are concerned, a 584 mn decline in expenditure has been identified when compared to the budget, mainly due to the lower uptake of co-financing expenditure foreseen by the Macroeconomic Forecasting Committee. The CBR expects a saving of 64 mn euros because the subject provision designated to cover for the corrections in the absorption of EU funds was not entirely spent, while a saving of 29 mn euros is estimated in the transfer to the EU budget.

The positive impact of interest revenue and expenditure is estimated by the CBR at 410 mn euros, with two factors contributing to the improvement of the budgeted deficit in this area. Already at the time of evaluation of the budget proposal for the 2023-2025 period, the CBR highlighted a positive risk to the budget balance when a higher estimate of ARDAL costs associated with resources available under the State Treasury refinancing system (mainly deposits and balances on the accounts of the general government entities) was not reflected in the budgeted interest revenues. At the same time, higher interest revenues during the year were due to the interest revenue on the State Treasury’s liquidity buffer resulting from higher interest rates on the market.

The slower pace of implementing investments compared to budget assumptions is reflected in lower expected capital expenditure at 407 mn euros. Such savings are also attributable to the failure to meet the budgetary expectations concerning the delivery of military equipment which, according to the ESA 2010 methodology, only becomes part of the general government deficit at the time of delivery.

Compared to the budget, the CBR estimates lower expenditure of 332 mn euros in the current expenditure of the state budget. The most significant savings include lower spending on goods and services at 187 mn euros and current reserves (except for EU and wages) at 155 mn euros, both of which were spent predominantly to cover additional expenditure of local governments and other general government entities. The positive impact of the scheme for subsidising renewable energy sources (green energy) compared to the budget assumptions comes in at 152 mn euros.

In comparison with the budgeted level, the estimated amount of collected non-tax revenues is lower by 138 mn euros. The most significant shortfalls are expected in the revenue from dividends projected by the TRFC at 110 mn euros, revenue from administrative charges totalling 102 mn euros and revenue of Železnice Slovenskej republiky (Railways of the Slovak Republic, ŽSR) in the amount of 32 mn euros. On the contrary, higher revenues compared to the budget were projected by the TRFC in connection with the gambling levy (by 45 mn euros) and the receipts of the Národná diaľničná spoločnosť (National Motorway Company, NDS) (by 17 mn euros); the CBR also estimates an increase in ŽSSK’s revenues (by 19 mn euros).

In line with the November forecast of the Tax Revenue Forecasting Committee, the CBR expects, in comparison with the budgeted amount, a decline by 335 mn euros in revenue from taxes and social contributions, excluding temporary revenue. Revenue is estimated to be lower in VAT by 488 mn euros, personal income tax (excl. tax assignation and tax credits) by 220 mn euros, and in health and social contributions by 219 mn euros. The CBR expects higher-than-budgeted revenues in corporate income tax by 363 mn euros, and in other taxes by 95 mn euros.

With a negative impact of 272 mn euros, the fiscal performance of municipalities is the main contributor to the worsened performance of local governments by 385 mn euros compared to budgeted levels. Capital expenditure is estimated to be higher by 250 mn euros, as are current transfers, up 166 mn euros, and personnel expenditure, up 120 mn euros in comparison with the budgeted level. For municipalities, the CBR expects a worsened fiscal performance, mainly due to higher capital expenditure arising from a faster pace of spending observed in the third quarter.

In case of health expenditure, CBR expects an increase by 472 mn euros compared to the budget. The higher expected amount is mainly due to increased expenditure on health care (a negative impact of 336 mn euros) and worse fiscal performance of hospitals, with an impact of 129 mn euros.

Other general government entities are expected to perform worse compared to the budgeted levels by 501 mn euros. The most significant negative impact is estimated under the fiscal performance of organisations partly funded from the state budget (157 mn euros), ŽSR (122 mn euros), NDS (111 mn euros), public universities (93 mn euros), radio and television broadcaster RTVS (26 mn euros) and the National Nuclear Fund (NNF) (25 mn euros).

As part of expenditures on social benefits and transfers, the CBR estimates an increase compared to the budgeted amount by 612 mn euros, which is mainly due to the Social Insurance Agency’s expenditures associated with the extraordinary indexation of pensions in July 2023.

Baseline scenario of 2023 and the long-term sustainability indicator

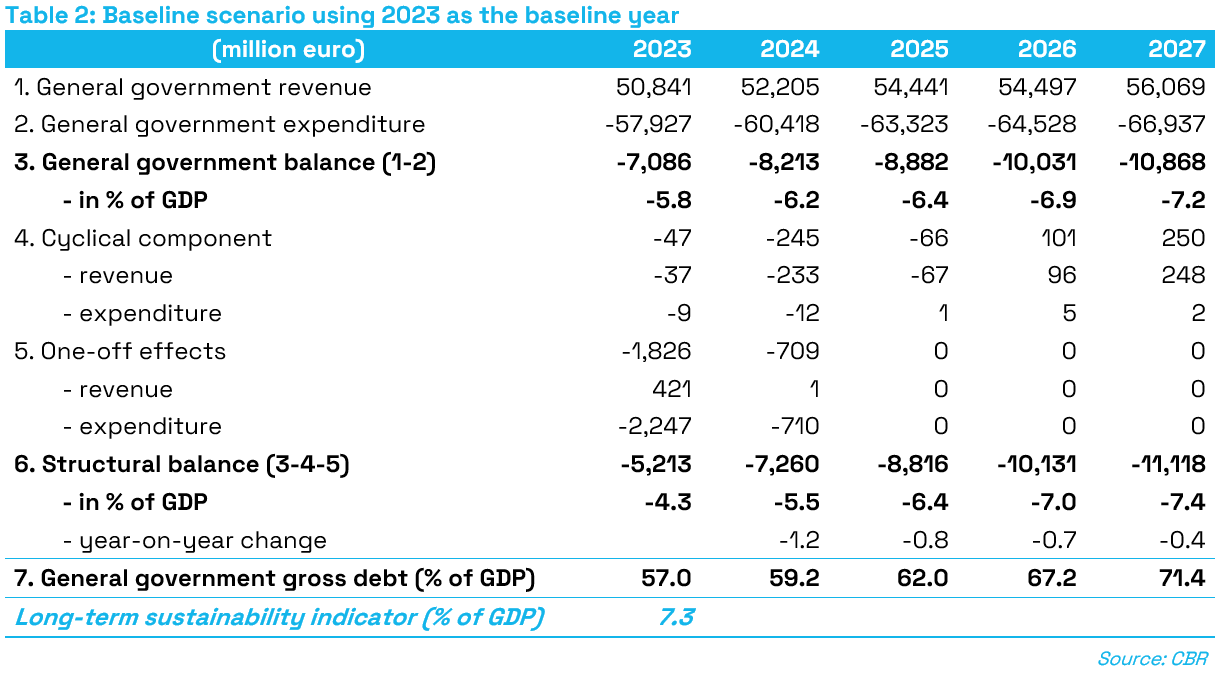

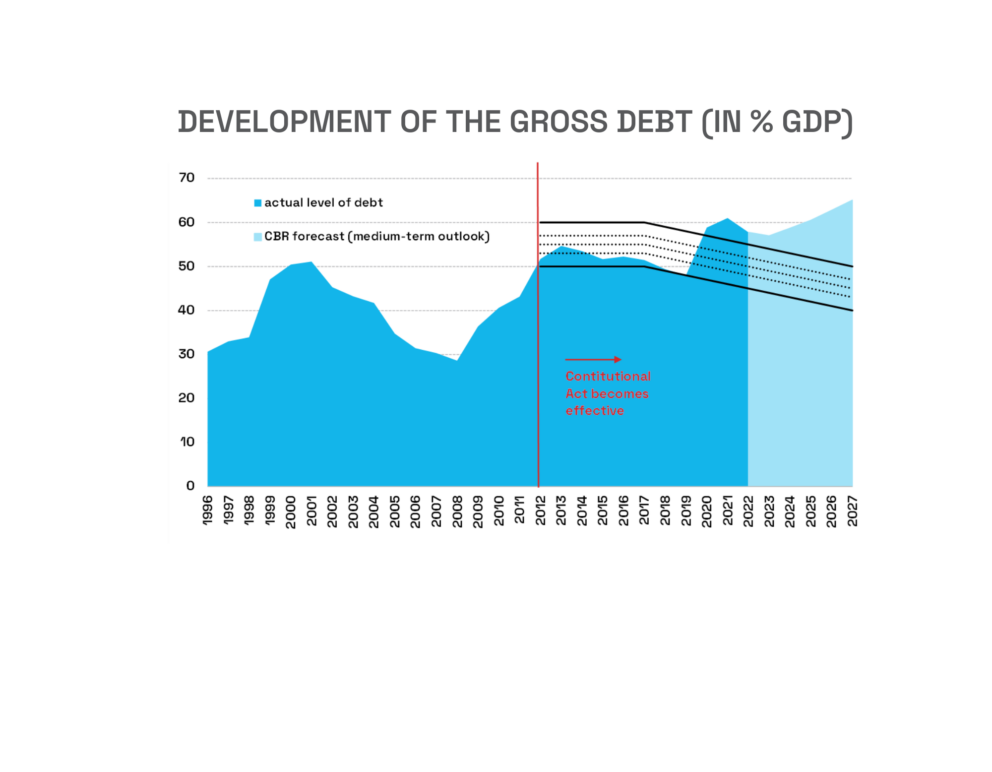

Based on the estimated balance in 2023, the baseline scenario assumes that, without taking additional measures, the deficit would gradually deteriorate from 5.8% of GDP in 2023 to 7.2% of GDP in 2027 (Table 2). Such an increase in the deficit would lead to a sharp increase in the debt-to-GDP ratio above 70% of GDP by the end of 2027. In line with the current legislation, this scenario[11] is used in the calculation of the public expenditure ceiling for 2024-2027.

Under the baseline scenario, the CBR estimates a structural deficit of 4.3% of GDP in 2023. The high baseline level of the structural deficit is also caused by measures approved during 2023 before the approval of the government’s manifesto and the vote of confidence in the government (a detailed list of legislative measures approved in 2023 is available in Annex 2). The measures introduced in 2023 increase the structural deficit by more than 800 mn euros (0.7% of GDP) in 2023 and their impact will gradually rise to 1.3 bn euros (0.8% of GDP) at the end of the horizon in 2027. In particular, these include the introduction of free meals at schools, the expenditure related to the Recovery and Resilience Plan (the Schools Act, funding for science and research), investments in industrial parks, as well as changes in social benefits.

Over the medium-term, the CBR estimates the structural deficit to deteriorate by 3.1 p.p. from 4.3% of GDP in 2023 to 7.4% of GDP in 2027, assuming no changes in policies. The main contributors to this development include the tax committee’s estimate of the structural revenue from taxes and social contributions[12] (down by as much as 2.1 p.p.), increase in debt interest payments (contributing with 0.8 p.p.), along with an increase in defence expenditure to 2 % of GDP per year (0.4 p.p.).

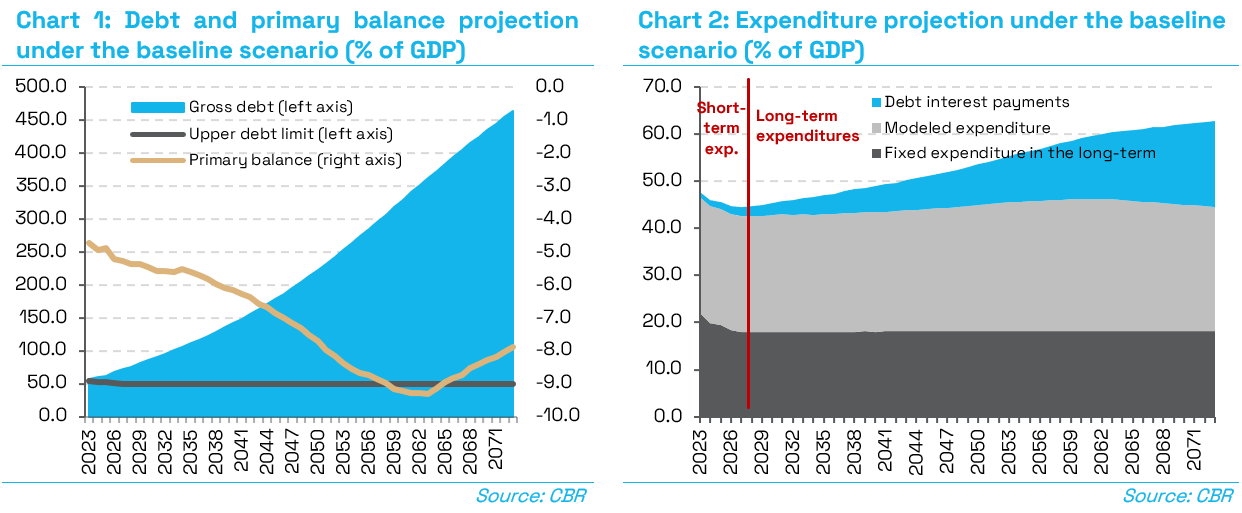

In the long-run, general government debt would rise uncontrollably over the entire horizon, according to this model forecast. In no single year it would fall below the highest debt-brake sanction bracket and the Maastricht criterion of 60% of GDP would be exceeded already in 2025. Assuming no changes in policies, the debt would reach 464.3% of GDP at the end of 2073 (Chart 1). This is a hypothetical scenario, as markets would stop financing Slovakia’s needs at significantly lower debt levels. Taking into account the response from financial markets, but also from households and businesses, the year of Slovakia’s theoretical inability to finance itself is getting significantly closer. At the same time, the Fiscal Responsibility Act sets the upper debt limit at 50% of GDP and defines graduated sanctions in case the debt starts approaching it. On this basis, the government would be required to respond to an increasing debt by introducing measures in line with the prescribed sanctions, which should prevent the debt from staying above the upper band.

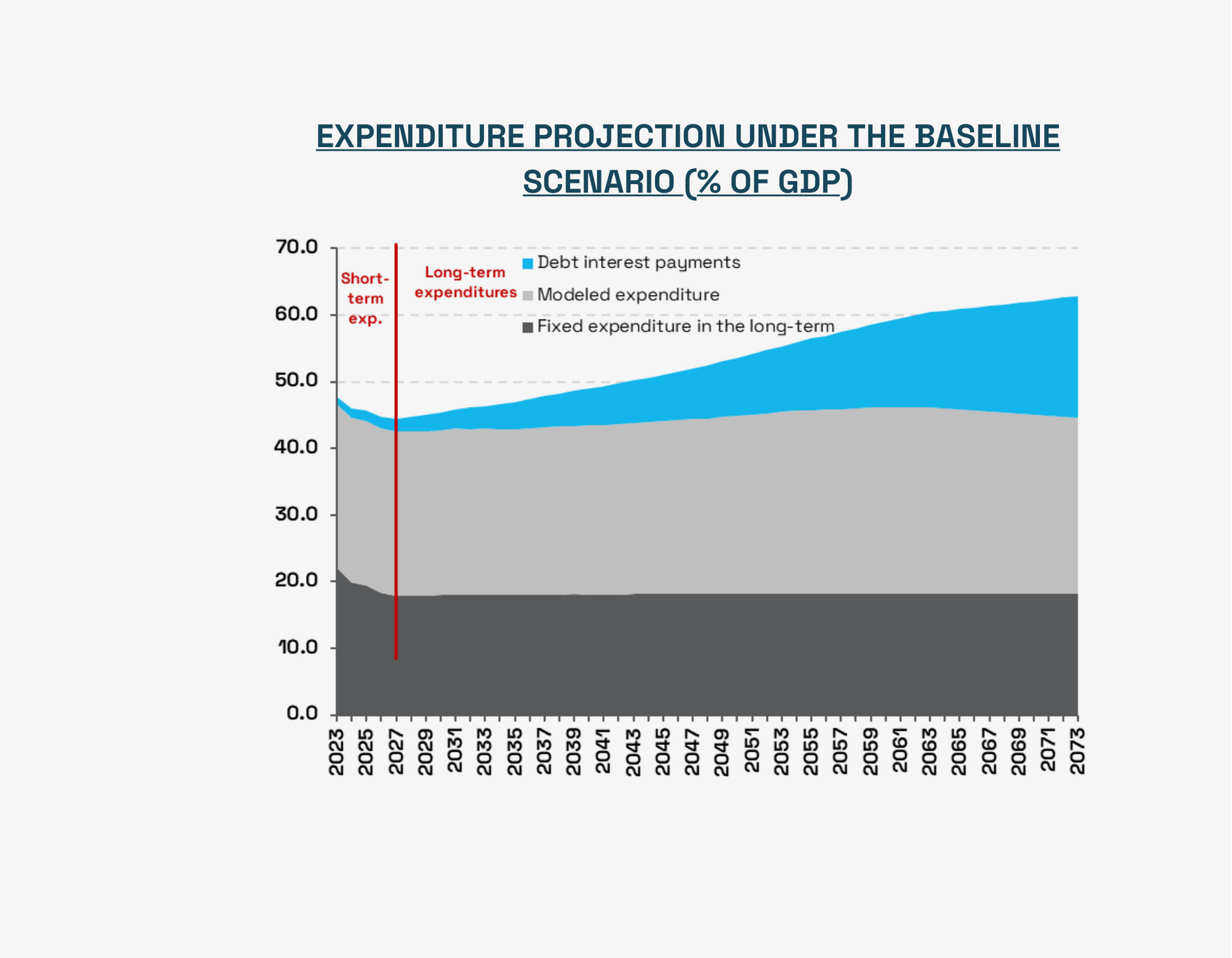

In the long-term perspective, the debt increase is determined by the rising expenditure sensitive to population ageing[13]. In turn, an increasing debt would cause the amount of interest paid to rise sharply, thus contributing to a further increase in the debt (Chart 2).

Assuming that the baseline scenario materialises, the long-term sustainability indicator would reach 7.3% of GDP[14], which means high[15] risks related to the long-term sustainability of public finances.