The Council for Budget Responsibility (CBR) submits to the National Council of the Slovak Republic (the parliament) public expenditure ceilings calculated in accordance with the requirements of §30aa of Act No. 523/2004 Coll. on the general government budgetary rules (further referred to as the “Act”) and the methodology agreed with the Ministry of Finance of the Slovak Republic (MF SR) on 22 December 2022[1]. The 2024-2027 expenditure ceilings presented in this report cover the term of office of the current government. Expenditure ceilings represent a key budgetary instrument to ensure long-term sustainability of public finances, and an essential operative tool of budgetary governance and consolidation of public finances.

The calculations presented in this document are based on macroeconomic and tax assumptions reflecting the legislative framework which was in force at the time of the approval of the government’s manifesto and the vote of confidence in the government by the parliament on 21 November 2023. In accordance with the Act which requires that the ceilings reflect the legislative framework valid at this time, the calculation does not include the impacts of new government measures approved by the parliament after the vote of confidence. The impacts of such new measures that affect general government revenues or long-term sustainability of public finances will be considered in an update to the public expenditure ceilings at the time when the government requests such update and will thus only be reflected in the ceilings subsequently.

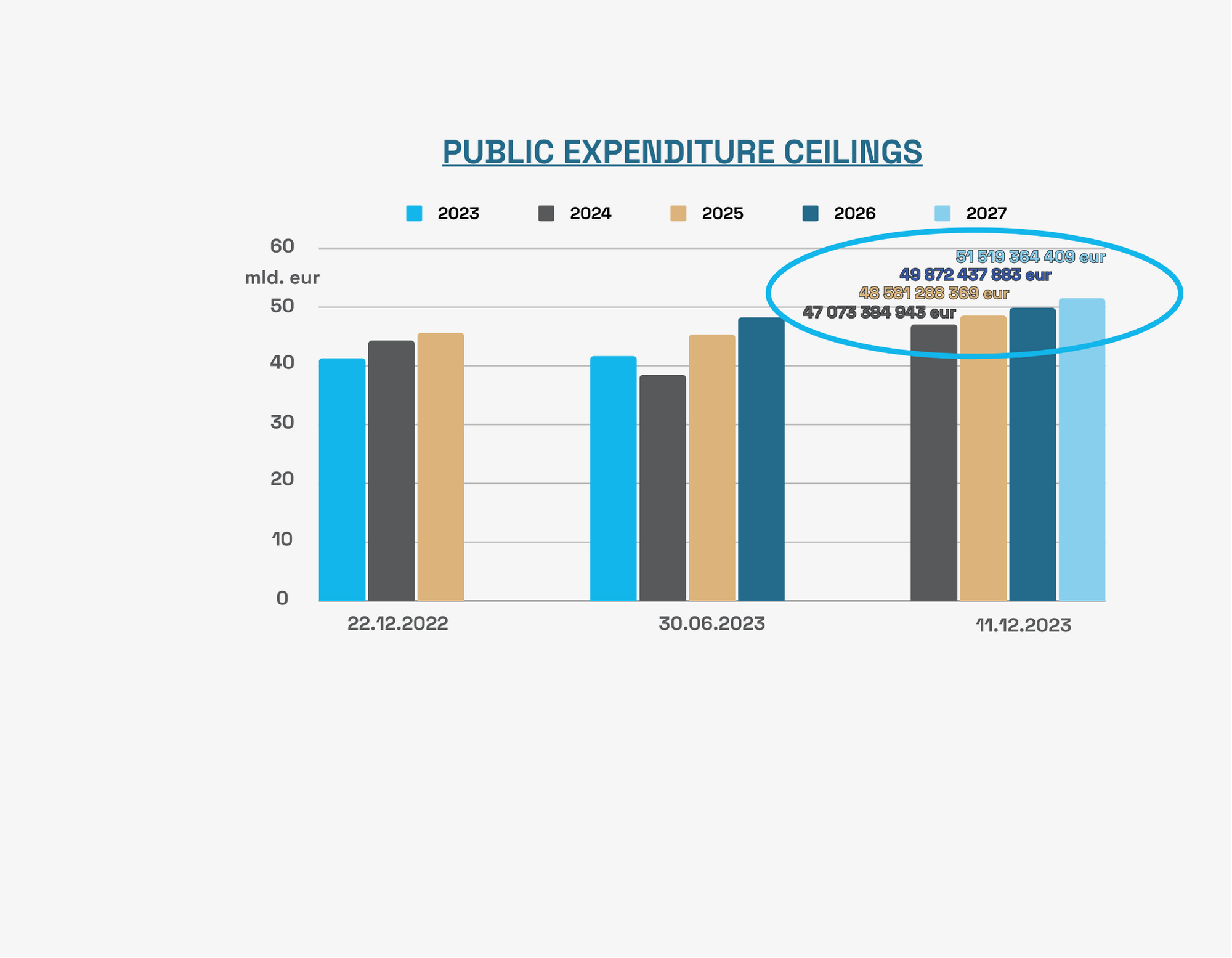

The new sums of expenditure ceilings will become effective following their approval by the parliament, replacing the previous sums approved for 2024 and 2025 by the parliament on 1 February 2023. As the validity of the general escape clause, which exempts the government from the obligation to align the general government budget with the expenditure ceilings for the duration of its validity, is to be deactivated at the end of 2023, the government is obliged to align the 2024-2026 general government budget with the valid public expenditure ceilings.

How public expenditure ceilings are calculated

The expenditure ceilings are calculated using a baseline scenario of development in general government revenues and expenditures prepared for the period of next 50 years, published by the CBR in an special report on the long-term sustainability of public finances[3]. The baseline scenario is based on an estimate of the general government balance for 2023 and fully reflects the legislative framework in force at the time of the approval of the government’s manifesto and the vote of confidence in the government by the parliament.

The baseline scenario serves to set the planned value of structural balance[4], which is then used in the calculation of expenditure ceilings for individual years. The value of the long-term sustainability indicator describes the current level of risk to public finances[5], on the basis of which an improvement in structural balance required over the next years is determined. This ensures the link between public expenditure ceilings and the long-term sustainability of public finances.

Baseline scenario of 2023 and the long-term sustainability indicator

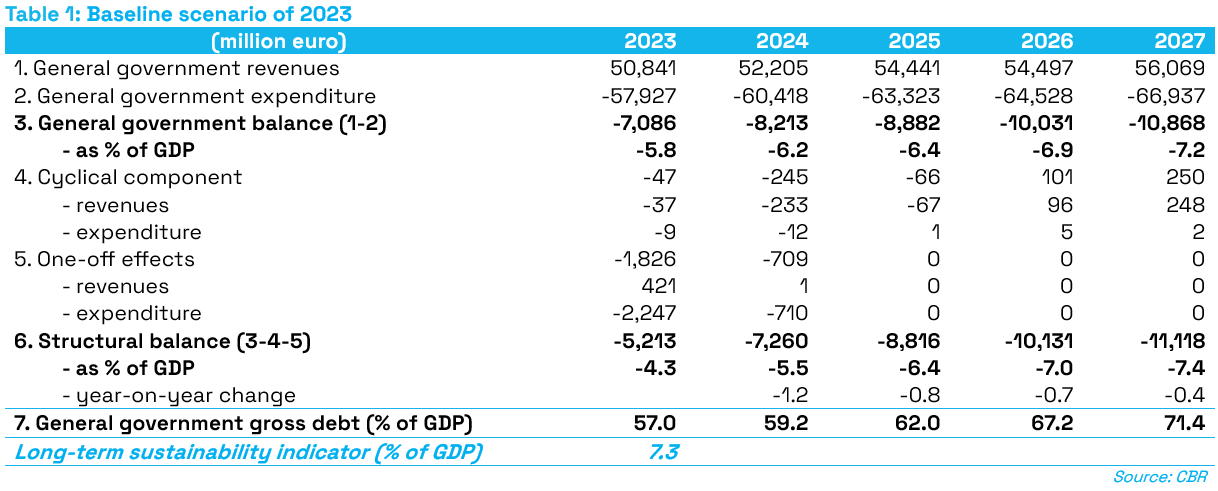

The baseline scenario of the development of public finances is based on a November 2023 forecast of the Macroeconomic Forecasting Committee (MFC) and the Tax Revenue Forecasting Committee (TRFC) (its assumptions and the balance of revenue and expenditure are included in Annex 1). The CBR estimates the general government deficit at 5.8% of GDP in 2023, which is 4.3% of GDP in structural terms (Table 1). Under the baseline scenario (i.e., excluding additional measures), the CBR expects the structural deficit to gradually increase in the subsequent years to 5.5% of GDP in 2024, 6.4% of GDP in 2025, 7.0% of GDP in 2026, and 7.4% of GDP in 2027[6]. This development is used as the starting point for the calculation of public expenditure ceilings for the period of 2024 to 2027. The long-term sustainability indicator is at 7.3% of GDP under the baseline scenario, which means high risks of the long-term sustainability of public finances.

Calculation of public expenditure ceilings for 2024 to 2027

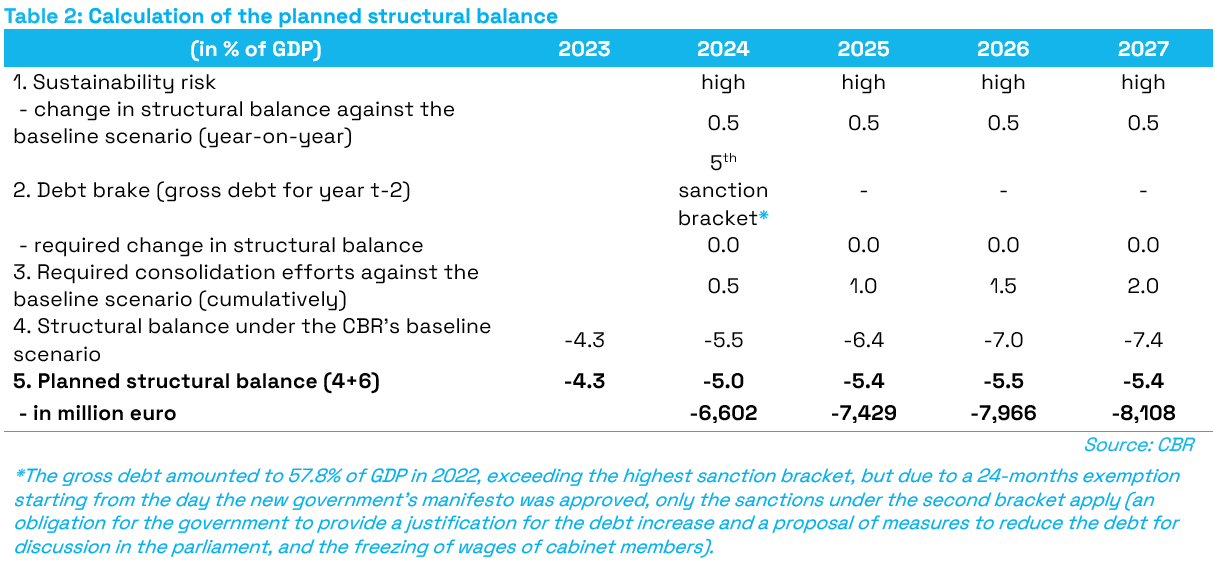

The following aspects are considered when setting the value of planned structural balance which serves as the basis for calculation of public expenditure ceilings (Table 2):

- the level of risk to long-term sustainability of public finances; and

- some sanctions under the debt brake.

According to the baseline scenario, the risks associated with long-term sustainability remain high throughout the entire horizon covered by the calculation, which means that the requirement to improve the structural balance by 0.5% of GDP per year against the baseline scenario applies to all years for which the expenditure ceilings are calculated. Even if this level of consolidation was achieved, the long-term sustainability indicator would still remain in the high-risk zone at the end of 2027.

The size of gross debt is currently above the highest sanction bracket, but due to the application of a 24-months exemption starting from the day the new government’s manifesto was approved, the most strict debt brake sanctions do not apply, therefore, they do not affect the calculation of expenditure ceilings. Potential sanctions triggered by the size of gross debt following the end of the 24-month exemption period (concerning years 2026 and 2027) cannot be accurately specified[7] at the moment, therefore they have not been included in the calculation of the planned structural balance. Any such implications will be addressed in the updates to the public expenditure ceilings at a relevant time.

Using the planned structural balance for the 2024-2027 period, the CBR’s data and the data provided by the Ministry of Finance for the period of 2024-2026, the CBR has calculated the public expenditure ceilings for the 2024-2027 period (Table 3)[8].

[1] CBR, Methodology for calculation, updates to, and evaluation of compliance with public expenditure ceilings, 22 December 2022

[2] The ceilings were approved by parliamentary resolution No. 1964 of 1 February 2023. The CBR published a legal opinion on the validity of expenditure ceilings on its website.

[3] CBR, Special Report on the Long-Term Sustainability of Public Finances, December 2023.

[4] In accordance with §30aa(6) of the Act on General Government Budgetary Rules.

[5] The long-term sustainability indicator below 1% of GDP is considered by the CBR a moderate deviation from long-term sustainability, associated with a low level of risk. The indicator value between 1 and 5% of GDP represents a medium risk. The long-term sustainability indicator above 5% of GDP is considered a high risk to the long-term sustainability of public finances. At high and medium risk to the long-term sustainability of public finances, the value of the planned structural balance is set in a way to improve the long-term sustainability indicator against the baseline scenario by 0.5% of GDP per year, at low risk by 0.25% of GDP. If the fiscal performance of the Slovak Republic is sustainable in the long-term (the indicator has a negative value), the CBR calculates the value of the planned structural balance in a way to keep the indicator at a zero value in each year. The calculation also takes into account the currently applicable debt brake sanctions (Article 4 and 12 of constitutional Act No. 493/2011 Coll. on fiscal responsibility).

[6] The deterioration in the structural balance results from the decrease in the share of excise taxes in GDP amid high inflation, growing pension expenditure and debt interest costs, as well as measures adopted in 2023 (see Annex 2).

[7] For example, it remains unclear whether the sanction under which the government has an obligation to prepare a balanced budget would apply in 2026 already, or in 2027 only. In general, the CBR updates the public expenditure ceilings by the most stringent debt brake sanctions only after they are triggered; i.e., the expenditure ceilings are not updated solely on the basis of a forecast.

[8] In the case of tax and non-tax revenues forecasted by the TRFC, the CBR used its own estimate which is identical to this assumption in the baseline scenario. For 2027, the CBR adopted its own estimates from the baseline scenario for all items, because the data provided by the Ministry of Finance only covered the 2024-2026 period for which a budget proposal is prepared. Detailed calculation, including the identification of source data, is included in a separate annex published along with this document.