Based on data published by the Statistical Office of the Slovak Republic on 22 April 2024 – the spring notification of deficit and debt

Summary

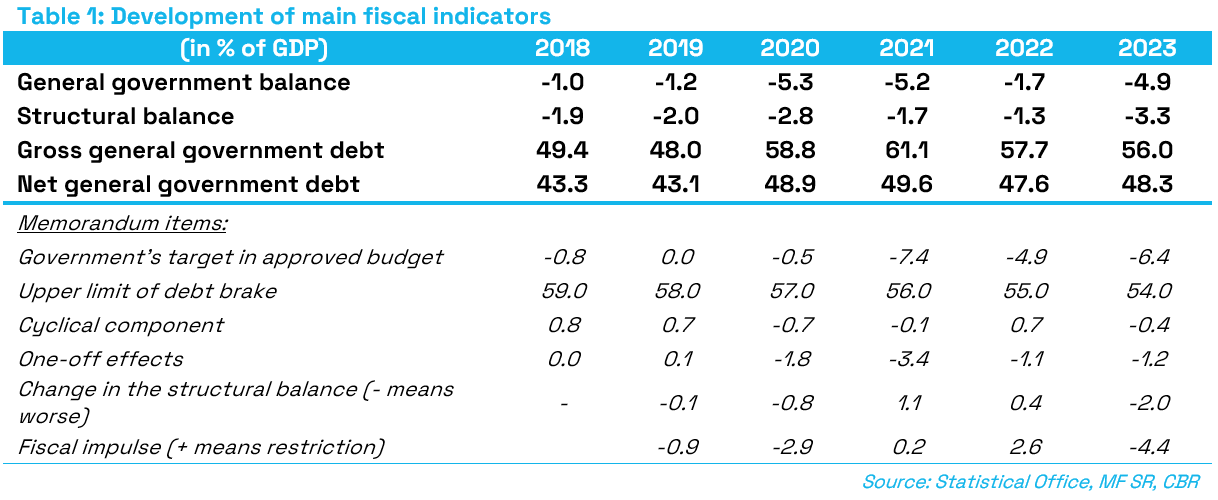

The deficit of the general government (GG)[1] reached 4.9 % of GDP in 2023, marking a return from a temporarily low deficit in 2022 to the high levels seen in the pandemic years 2020 and 2021. Compared to the budgetary target of 6.4 % of GDP, the actual deficit implies a positive deviation of 1.5 % of GDP and, after the years 2021 and 2022, it is also the third most significant improvement in the final fiscal result compared to the budget since 2005. Gross debt stood at 56.0 % of GDP, down by 1.7 p.p. year-on-year, which means that the final value is as much as 1.9 % of GDP lower compared to the budgetary assumptions. However, it is still 2 % of GDP above the upper limit of the debt brake.

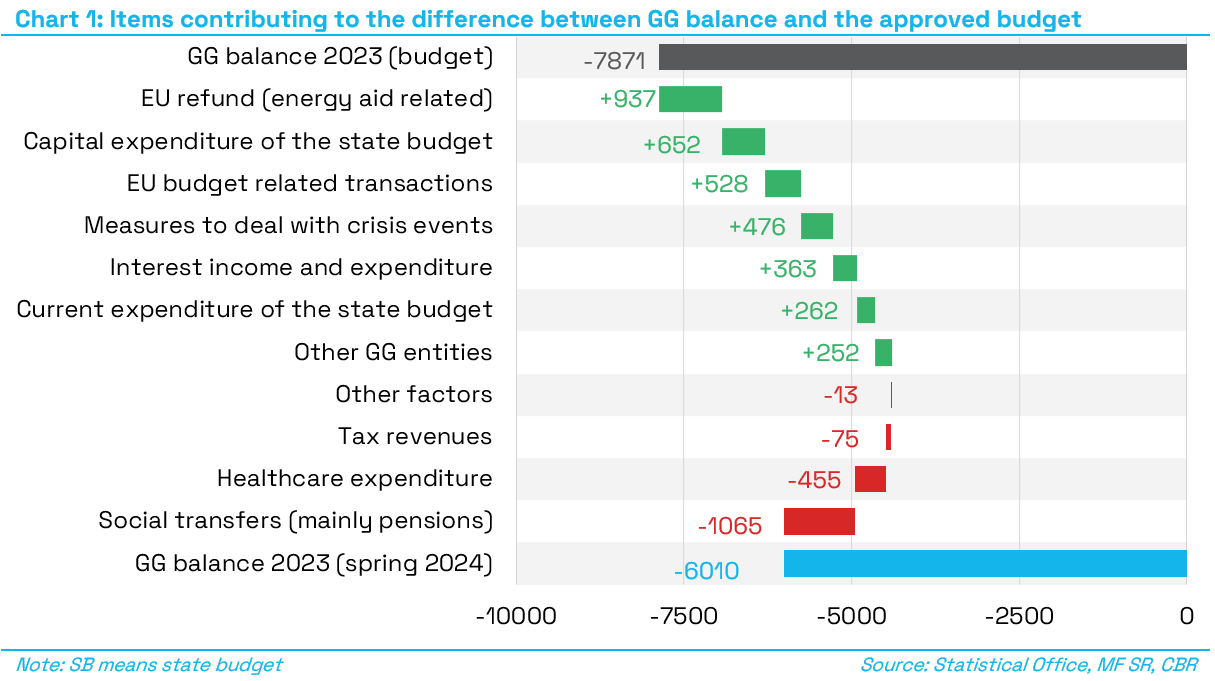

The most significant positive deviation[2] from the budget as regards the general government fiscal performance in 2023 was directly linked to the successful negotiation of reimbursements for energy subsidies from EU funds (0.8 % of GDP), which was not foreseen in the budget. At the same time, these reimbursements from EU Funds were fully accounted for in the fiscal performance for 2023, as assumed by the CBR. Conversely, the most significant negative deviation from the budget was attributable in particular to the adoption of new measures concerning pension benefits (0.8 % of GDP) in the course of the year, which were not foreseen in the budget. In addition, the measures of a more permanent nature showed a lower increase in expenditure in the state budget as well as in the fiscal performance of other general government entities.

- On the positive side, the cost of financing temporary measures was lower than anticipated in the budget, down 1.4 bn euros (1.3 % of GDP), mainly due to the reimbursement of a large portion of the cost of the schemes compensating for high energy prices from EU funds; at the same time, the final costs fell short of reaching the high levels foreseen in the budget also due to lower energy prices on the markets.

- Conversely, the general government deficit was negatively affected by the costs of extraordinary indexation of pensions and some social benefits, as well as the costs of extraordinary allowance for pensioners (which will later be reflected in the increased 13th pension payments), thus causing an increase in the budget deficit, up 1.1 bn euros (1.0 % of GDP).

- There were also other major factors not directly related to extraordinary circumstances or measures adopted on an ongoing basis that contributed to the difference between the final fiscal results and the budgetary target. The slower spending of state budget capital expenditure brought in savings of 652 mn euros (0.6 % of GDP), especially due to the lower value of military equipment deliveries in the defence sector when compared to the budgetary assumptions. As regards transactions with the EU budget, the budget assumptions concerning the co-financing expenditure amounting to 528 mn euros (0.4 % of GDP) were not met (reimbursements of energy subsidies did not require co-financing, the new EU funds programming period saw a slower start, along with the slower uptake of funds under the Recovery and Resilience Plan).

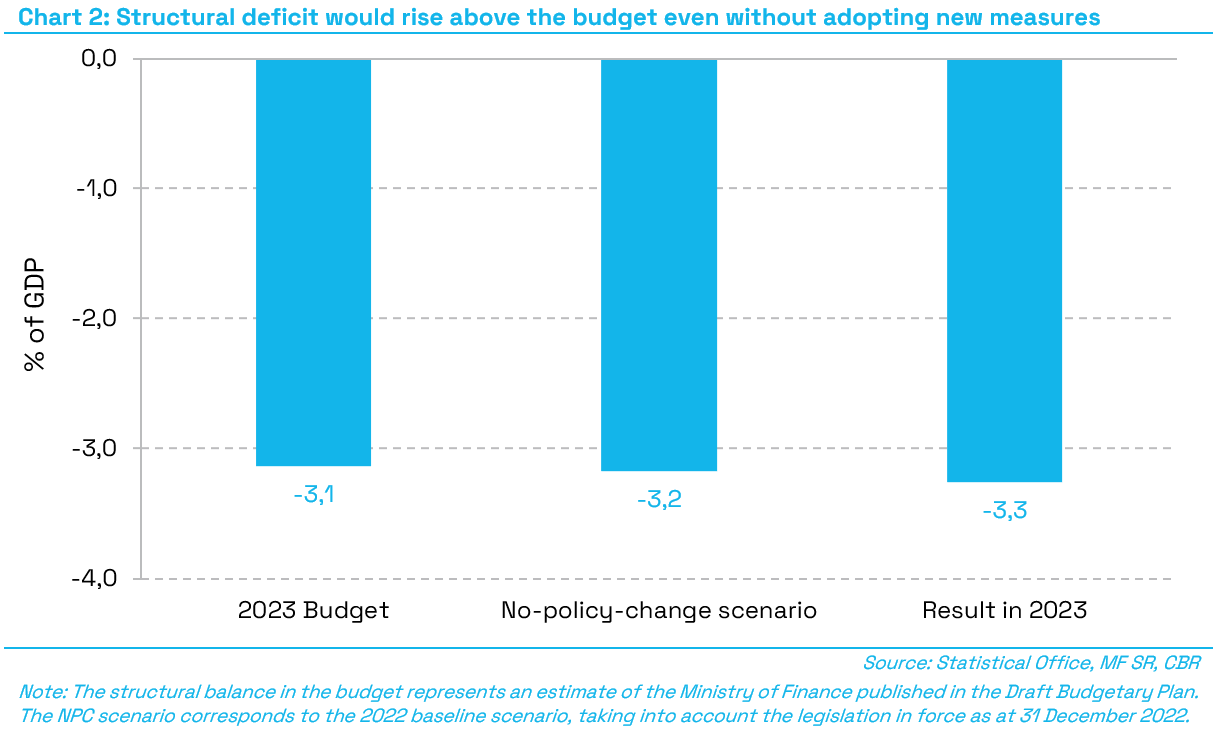

From the point of view of a medium-term burden on public finances, it is better to focus on the structural deficit indicator (i.e., a deficit that will automatically last even into the future, if no additional measures[3] are adopted). In 2023, the structural deficit increased year-on-year to 3.3% of GDP, up 2.0 p.p. from 2022 which saw the ever-lowest level of structural deficit at 1.3 % of GDP. The increase in the 2023 structural deficit is largely due to measures adopted in 2022 (family package, parental pension, indexation of wages in the health care sector), as well as during 2023 (extraordinary indexation of pensions and parental allowance, extraordinary allowance for pensioners). At the same time, high inflation had a positive effect on the structural balance in 2022; however, in 2023, the effect was negative. Nonetheless, the year-on-year growth is still driven by a delayed increase in public spending in response to inflation growth, while another increase is expected in 2024 especially in the area of social transfers and wages. Last but not least, due to advance payments, accrued defence spending in 2023 was significantly lower than the cash expenditures counting towards the NATO commitment. Therefore, the expected deliveries of military equipment will increase the structural deficit level in the medium term. For these reasons, the 2023 structural balance may not give a full picture of public finances in the medium term.

If no new measures were adopted in 2023 and public finances evolved in line with economic developments (NPC scenario), the structural deficit would reach 3.2 % of GDP. The structural deficit would therefore be up by 0.1 % of GDP compared to the budget assumptions even without the adoption of additional measures. At the same time, new measures implemented in 2023 contributed to an increase in the structural deficit by 0.1 % of GDP. As regards the impact on the general government balance, the new legislative measures, which increased the expenditure by as much as 1.1 % of GDP, were almost entirely offset by positive developments in other areas of the budget. Compared to the NPC scenario, the positive impact on the structural balance in 2023 is mainly attributable to low investment in the defence sector, improved tax revenues and lower co-financing expenditure.

The gross debt stood at 56 % of GDP. After 2022, this is another year-on-year decline, down by 1.7 p. p. of GDP, from 57.7 % of GDP in 2022. But, regardless of this decline, the gross debt was still above the highest sanction bracket of the debt brake in 2023. High inflation had the largest effect on the year-on-year debt decline in 2023 through the denominator effect (contributing -5.5 p.p.) along with a decline in the government’s cash reserve (contributing -1.3 p.p.). In both cases, however, this is only a temporary effect which has already run out, assuming a gradual decline in the inflation rate while the cash reserve relative to GDP is converging to its historical levels as well.

The year-on-year debt-to-GDP growth was slowed down by real economic growth, contributing 0.6 p.p. mainly due to subdued domestic and foreign demand. The high primary deficit of the general government, combined with interest costs, had the opposite effect on the debt (a cumulative contribution of 4.9 p.p.). Combined with a decline in the cash reserve in 2023, high inflation outweighed the contributions of the primary deficit and interest costs, thus resulting in a year-on-year decline in gross debt. Slovakia’s rising risk premium has so far had only a modest impact on the results for 2023.

Fiscal policy (coupled with EU funding and one-off expenditures) supplied a notable expansionary impulse of 4.4 % of GDP in 2023. The high rate of fiscal expansion is based in particular on the year-on-year increase in expenditure from EU funds as the programming period is drawing to its end, complemented by an increase in the structural deficit and new measures to compensate for higher prices. As opposed to permanent measures, the temporary and targeted measures are best suited to respond to this type of crisis because once the crisis is over, these measures expire as well and will not burden public finances over the long term. Adjusted for the cumulative effect of EU funds and one-off measures, i.e. focusing on the change in the structural balance, the fiscal impulse in 2023 was still significantly expansionary at 2.3 % of GDP despite the closing output gap in the economy.

Total expenditures to finance the measures adopted by the government in response to exceptional circumstances, i.e. compensations for the high growth in prices, as well as costs of dealing with the pandemic and the war in Ukraine, amounted to 3.2 bn euros (2.6 % of GDP). After deducting the EU refunds for energy compensation schemes (not accounted for in the budget), extraordinary taxes of windfall profits and grants received by the defence sector in connection with the delivery of military equipment to Ukraine, these measures increased the general government deficit by 1.7 bn euros (1.4 % of GDP) in 2023; however, all of them were one-off measures that have no effect on the structural deficit. On the other hand, the budget foresaw the financing of temporary measures at 3.7 bn euros, with an overall effect on the deficit totalling 3.1 bn euros after taking revenues into account. The spending under temporary measures was significantly lower (mainly due to the successful negotiation of EU refunds for energy compensation schemes by the previous government and lower world energy prices), thus reducing the deficit by 1.4 bn euros (1.1 % of GDP) compared to the budget. Excluding the impact of one-off measures, the deficit was lower by 449 mn euros (0.4 % of GDP) – see Chart 3.

- The costs of measures to compensate the high growth in prices totalled 2,922 mn euros (2.4 % of GDP). The government operated multiple aid schemes aimed at stabilising energy prices for households and various types of companies or institutions. The expenditure was partly offset by 937 mn euros (0.8 % of GDP) in EU refunds, as well as by windfall revenue of 334 mn euros (0.3 % of GDP) from the solidarity contribution from activities in selected economic sectors and from the levy on surplus revenues of power plants. As a result, the measures to compensate high energy prices increased the general government deficit by 1,651 mn euros (1.3 % of GDP).

- The costs of financing other measures taken in connection with the Russian invasion of Ukraine amounted to 152 mn euros (0.1 % of GDP). The expenditures spent on humanitarian aid, contributions for the accommodation of refugees from Ukraine and other additional costs were partially offset by the grants received by the defence ministry for the delivery of military equipment to Ukraine. The net budgetary impacts of these measures amounted to 108 mn euros (0.1 % of GDP).

- Expenditure totalling 91 mn euros (0.1 % of GDP), entirely for the procurement of vaccines, was financed within the pandemic-related measures.

EU refunds for energy compensation schemes have been fully recorded in the fiscal performance in 2023, even though cash payments of around 0.5 bn euros were received already in 2023. The remaining amount is expected to be received in 2024 following the final clearance of costs for the financing of the compensation schemes. The decision concerning the method of recording this transaction was made by the Statistical Office based on ESA 2010 methodology which accrues, with some exceptions, the revenue from the EU budget in the period of recording the public expenditure covered by this revenue.

The significantly lower deficit for 2023 suggests that, without additional measures, the deficit could reach a significantly higher level this year. Keeping this year’s budgetary target would imply a year-on-year increase in the deficit by as much as 1.1 % of GDP (1.8 bn euros), as opposed to the declared target of debt reduction by 0.5 % of GDP.

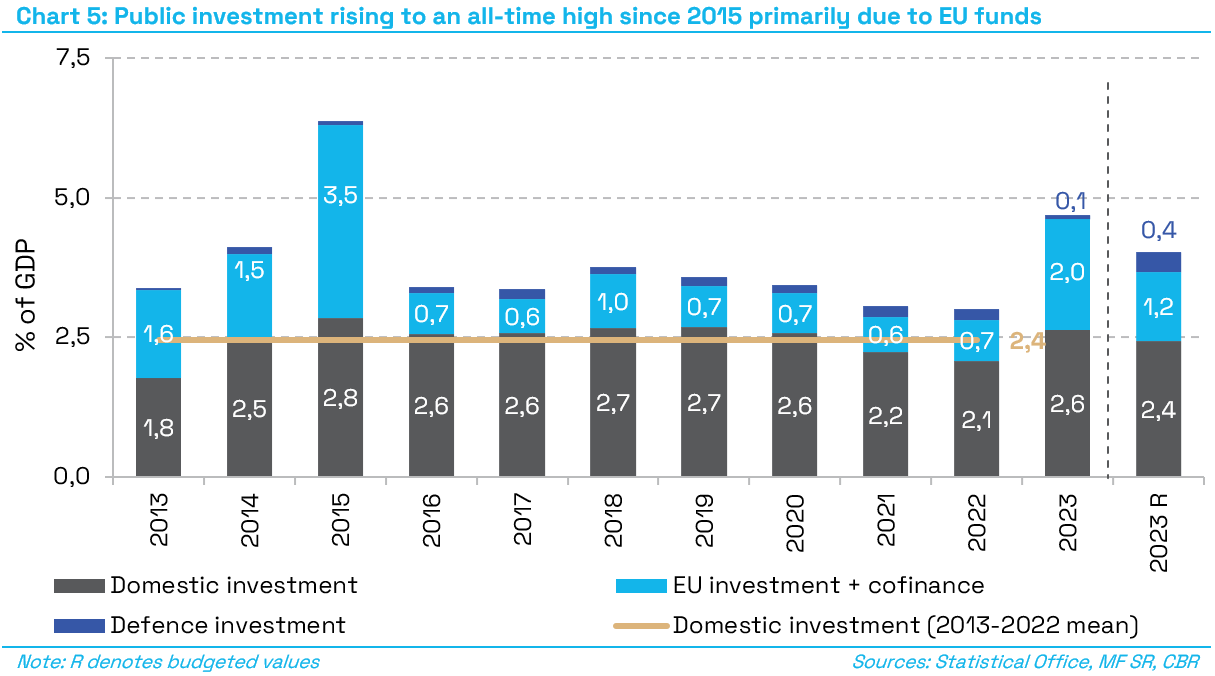

From the perspective of long-term sustainability, the long-term economic growth is important. It can be supported by the formation of new capital through effective public investments. In 2023, public investment reached 4.7 % of GDP, the highest since 2015. The increase was mainly driven by the spending of EU funds from the programming period that is nearing its end, with investment expenditure financed by EU funds and co-financing standing at 2.0 % of GDP.

Because the flow of European funds depends on a longer-term spending plan, as well as on the relevant programming period schedule, it will be interesting to observe the development of domestic public investments. At the same time, it is advisable to deduct the investments related to the military equipment, because the size of these expenditures recorded in the budget balance under ESA 2010 is to a large degree affected by delivery dates. In 2023, the uptake of domestic investments outside the defence sector showed a moderate year-on-year increase; however, unlike in previous years, it surpassed the level of capital expenditures included in the budget. The investments were 0.2 % of GDP higher than expected in the budget; on the one hand, this contributed to a higher structural deficit level, on the other hand, the government managed to sufficiently use the budgetary funds to support investments that are much needed for economic growth. The final size of domestic investments was above the level of historical average since the previous crisis.

[1] For the purpose of assessing the development in public finances, the general government consists of the central government (state budget, organisations partly funded from the state budget, and other general government entities), the Social Insurance Agency and health insurance companies, and local government (municipalities and self-governing regions).

[2] The document presents analytically adjusted items contributing to the change in the balance; in aggregate, the adjustments have a zero impact on the general government balance. Therefore, the individual effects do not necessarily correspond to the data specified in the Final State Budgetary Account for 2023. Under the ESA 2010 methodology, total revenues were 1,748mn euros higher compared to the budget, while total expenditures were 113mn euros below the budget.

[3] The structural balance does not include one-off and temporary measures that do not represent a burden on the development of public finance in the long term. At the same time, the cyclical effect of the economy on tax revenue and selected expenditures sensitive to economic development are subtracted from the nominal balance.