The government has published its budget objectives for the years to come. Apart from being important from the domestic fiscal perspective, these objectives are subject to EU-wide evaluation under the European Semester.

The analysis of stability programmes, convergence programmes and national reform programmes of individual Member States is done mainly to coordinate their economic policies and identify potential risks. This year, the plans towards reaching country-specific Medium-term Budgetary Objectives (MTO) of those MS which signed the Fiscal Compact will constitute an important element of evaluation. According to the constitutional Fiscal Responsibility Act, the CBR monitors and evaluates the development of public finances in Slovakia. The purpose of this document is to offer an impartial view on the medium-term budgetary objectives presented in the Stability Programme, as well as in the Medium-term Budget Outline for 2014 to 2016.

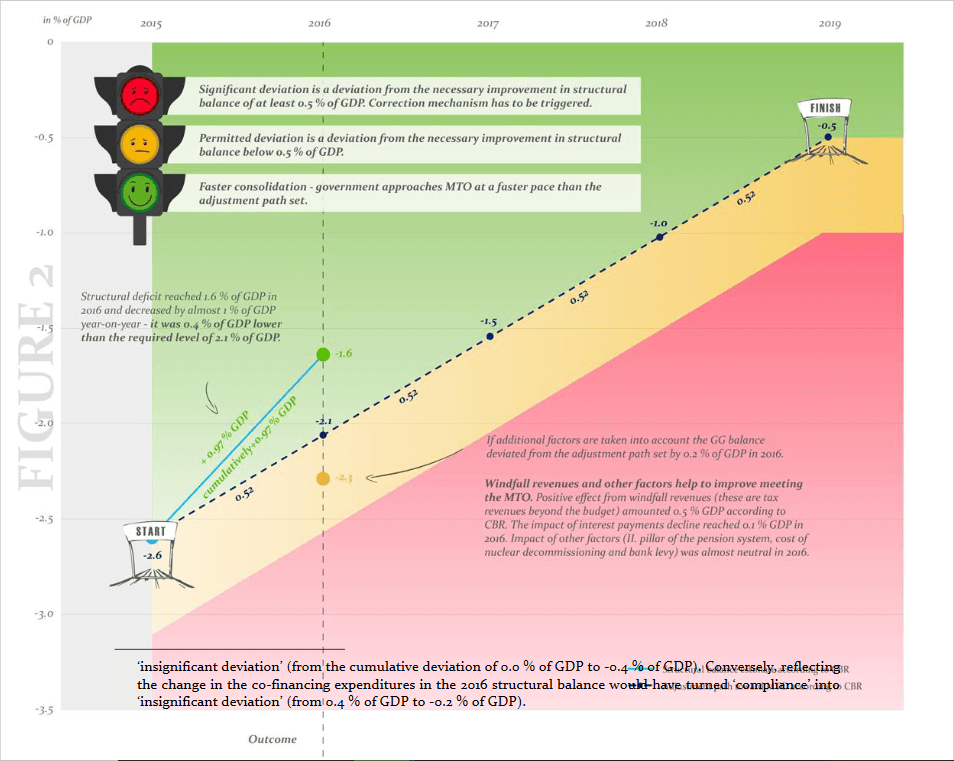

The Council views positively the fact that the government declares its intention to continue public finance consolidation at a pace set to ensure deficit reduction below 3% of GDP by 2013 on a sustainable basis, and to stabilise the level of general government debt. The proposal of the budgetary objectives respects both the domestic and international fiscal rules and presents a trajectory for reaching MTO by 2018 which, according to CBR calculations, would significantly improve the long-term sustainability of public finances in Slovakia. On the other hand, these plans are not yet accompanied by specific measures, nor do they indicate the steps to be taken should the external environment deterioration adversely affect the general government debt level.

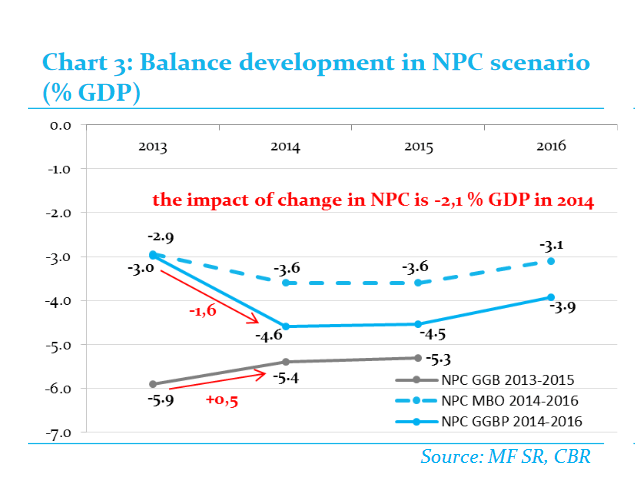

The 2012 deficit reached 4.3% of GDP, which is 0.3% of GDP better than the budget target. It is important to look at what this improvement means for 2013. The structure of revenues and expenditures shows considerable deviations from budgeted values in both positive and negative directions. The shortfall in revenues from taxes and social contributions was partially offset by the adopted legislative measures, but they still fell short of preventing a decrease by 0.6% of GDP against the budget target. On the other hand, the slower uptake of EU funds and hence the lower co-financing expenditures from the national budget, combined with lower transfers to the EU budget, have had a positive impact of 0.5% of GDP. Municipalities and public universities also outperformed their budgets. In view of the above-described deviations, the 2013 budget plans lower tax revenues. The result could again be positively influenced by lower capital expenditures of municipalities and lower co-financing, but this is not sustainable in the long term. In the case of public universities, the changes could be more permanent because they are mostly connected with higher non-tax revenues.

In its evaluation of the budget proposal at the end of 2012 the CBR indentified a number of risks and concluded that the ambition to reach the 2013 target is realistic, however, only if additional measures are taken. Several of these risks have materialized in the meantime and prompted budget adjustments. The parliament has endorsed an increase of salaries in the system of regional schools. The concerns expressed by the CBR regarding the worse economic development have also materialized and led to the revision of macroeconomic forecasts and the dissolution of a reserve created for this purpose in the amount of €313m. On a positive note, the assets of the fully-funded pillar savers who switched to the pay-as-you-go pillar were not used to cover current expenditures, but rather to reduce deficit (the reserve was also dissolved). Municipalities, self-governing regions, healthcare sector and changes in the system of taxes and social contributions also featured prominently among the risk areas identified. Since the better performance of municipalities in 2012 was mainly due to lower capital expenditures, the CBR continues to see risks in achieving their current expenditure targets. The Ministry of Finance does not have the actual budgets of municipalities, yet. The healthcare sector may come as a negative surprise – according to the Ministry of Finance, the debt of hospitals increased by €130m in 2012, yet the 2013 budget does not foresee its further increase. However, big hospitals themselves are planning losses amounting to several millions EUR. Given the absence of a sufficiently long time series for 2013, the risks in the area of taxes arising from changes in legislation cannot be quantified at this point. As a consequence of the adopted measures, dissolution of the budget reserves and, potentially, the maximum possible uptake of EU funds, the 2013 actual deficit may end up close to the target, which will be an important starting point for consolidation in the years to come.

The 2014-2016 Medium-term Budget Outline and the Stability Programme had to reconcile a number of objectives. The first objective is to correct excessive deficit in line with the requirements of the Stability and Growth Pact . The second objective is to stabilise the level of public debt which in 2012 exceeded the first threshold defined in the national fiscal rules. And last, but not least, given the unfavourable economic development, fiscal policy should be as growth friendly as possible.

The Council views positively the fact that the government declares its intention to continue public finance consolidation at a pace set to ensure deficit reduction below 3% of GDP by 2013 on a sustainable basis, and to stabilise the level of general government debt. The average annual consolidation effort in 2013 to 2016 should reach 0.8% of GDP. These fiscal objectives have been set in direct reaction to the debt-brake sanction mechanisms defined in the Fiscal Responsibility Act. On the other hand, specific measures designed to reach these objectives are missing.

In general, a deficit reduction has an adverse impact on economic growth. However, this impact can be largely eliminated, or at least mitigated, through increased absorption of EU funds and higher efficacy of spending and collection of taxes. In the medium term, economic growth can also be fostered through the adoption of structural measures, for example those recommended by the OECD or the Commission. Given the volatilities on financial markets and possible radical changes in how the markets perceive the creditworthiness of a country, the Council attaches particular importance to those measures that lead to debt stabilisation and its subsequent reduction. This is also essential with regard to ensuring compliance with the constitutional Fiscal Responsibility Act, which sets the debt ceiling at 60% of GDP.

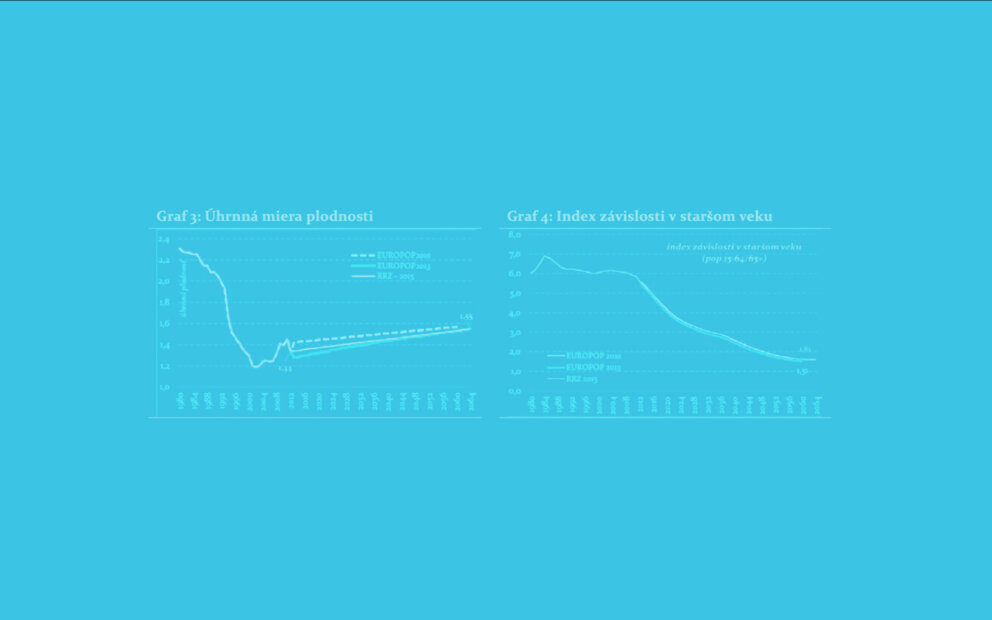

The macroeconomic assumptions contained in the draft Medium-term Budget Outline were, at the time they were made, evaluated by the Macroeconomic Forecasting Committee as realistic. Despite present uncertainties, the risks are now better balanced than at the time when the 2013-2015 budget was prepared. Nevertheless, a slight downward revision of the growth forecast cannot be excluded.

The tax and social contribution revenues have been approved by the Tax Revenue Forecasting Committee. The medium-term budget outline has been updated to reflect, in particular, the new macroeconomic forecast. The major risks of the forecast are associated with possible deterioration of the economic development and the measures adopted at the end of 2012 and in 2013. Since is not possible to assess the changes in the behaviour of those affected and their ultimate impact on budget revenues, they constitute a risk of the forecast. The increase in the tax burden is bound to induce significant dynamic effects, particularly when it comes to the self-employed, casual workers and legal persons, as they will seek to minimize the impact of the increased burden of taxation and social contributions.

The medium-term budget outline is the first step in the process of budget compilation. Since its main purpose is to specify budgetary objectives, the outline does not contain a detailed description of the measures designed to reach the objectives. Some measures (about one third), contemplating a freeze on wage expenditures and expenditures on goods and services at the 2013 level (with some exceptions), are already incorporated directly into the medium-term budget outline, the rest will be specified at a later point.

The analysis of expenditures shows that without additional reductions in the operating expenses (over and above those already incorporated), significant savings will only be achievable through changes in the legislation governing social care expenditures (healthcare including). Alternatively, the government may look for new resources on the revenue side.

In terms of compliance with the fiscal rules, the budget proposal can be evaluated positively. The proposal is in line with the rules defined in both the domestic and international legislation. Although the debt in the medium-term horizon will attack 57% of GDP, the government has declared its intention to keep it below this level. If the scenario presented in the medium-term budget outline materialized, the government would have to block 3% of the 2015 budget expenditures and the budget proposal for 2016 should not contain any nominal increase in expenditures (including social security funds). However, the documents at this point do not contain alternatives that would cater for situations where gross debt would increase due deteriorating external environment. On the other hand, increase in liquid financial assets to 4-5% of GDP provides certain room for manoeuvre.