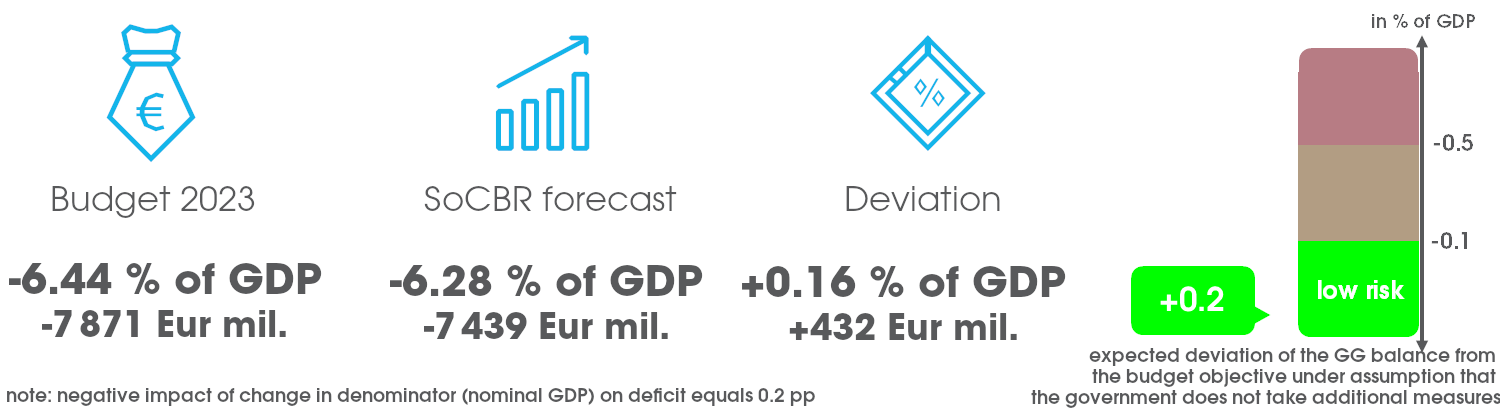

Secretariat of the Council for Budget Responsibility (SoCBR) estimates the 2023 General Government Budget (GGB) deficit at 6.3 % of GDP

• SoCBR has slightly increased the estimated level of GGB deficit in 2023. Negative difference compared to the January forecast amounts to EUR 46 million. Under the assumption that the government does not take additional measures, the deficit can reach the amount of EUR 7 439 million (6.3 % of GDP). Month-to-month increasing of GG deficit is mainly caused by lower expected tax revenue due to non-approval of the special pipeline tax as well as updating macroeconomic forecast, which expects lower inflation expected this year to channel into slower growth of tax bases.

• Estimated deviation between the SoCBR’s forecast for the 2023 GGB balance and the approved budget is positive at 0.2 % of GDP, which means that the risk of the public deficit level rising above the government objective is low.

• Expected expenditures of government measures to compensate high energy prices reach the level of EUR 3 195 million (2.7 % of GDP), of which expenses in the amount of EUR 456 million (0.4 % of GDP) should be financed from EU funds. After considering budgeted reserve and revenue from the windfall taxation of electricity production is the overall impact of measures on the budget deficit positive in the amount of EUR 315 million (0.3 % of GDP).

• We forecast the most significant positive impact on the GG balance in current expenditures of the state budget, where we expect savings of EUR 651 million (0.5 % of GDP) compared to the budgeted level. The lower expense level results mainly from assumed saving of reserve budgeted for financing of children’s leisure activities, the deficit is also reduced by savings in operating costs expected due to lower spending at the end of 2022.

• Income from tax revenues and social contributions represents the most significant negative risk for the budget balance, the estimated shortfall reaches the level of EUR 590 million (0.5 % of GDP). Revenues are reduced by measures not included in the budget, in particular the reduction of the VAT rate for the restaurants and catering services and increase in the tax bonus.