The Council for Budget Responsibility (the Council, CBR) has prepared an update to its evaluation of the general government budget for 2022-2024. The addendum assesses the differences between the government’s budget proposal and the version approved by the National Council of the Slovak Republic (the parliament). The evaluation also takes into account additional documents provided by the Ministry of Finance of the Slovak Republic (the Ministry and/or the Ministry of Finance, MF SR).

Compared to the government’s proposal, the version approved by the parliament has undergone only minimal changes and the expected budget balance levels in individual years remained intact. The changes were related to the capital expenditure structure of the state budget chapters without any impact on the level of overall general government revenues and expenditures. The approved budget envisages a deficit of 4.9% of GDP in 2022, 3.4% of GDP in 2023 and 3.3% of GDP in 2024.

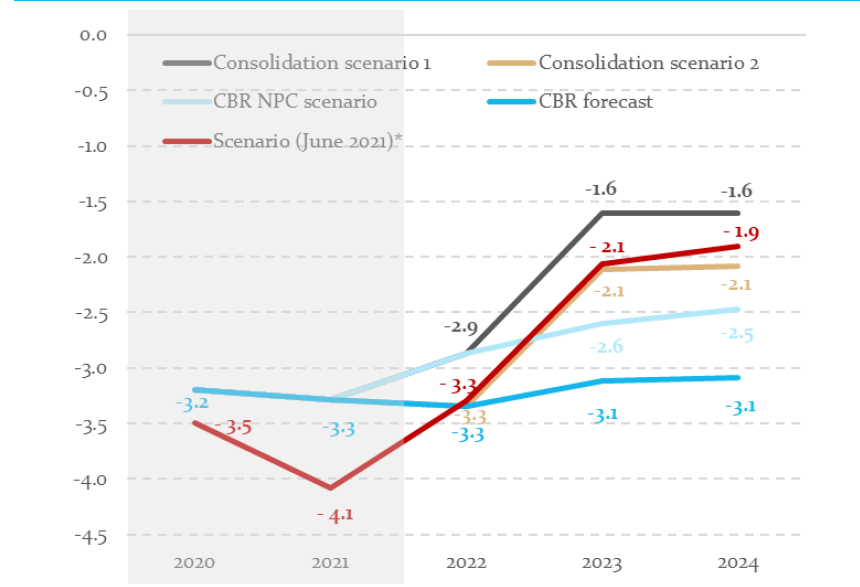

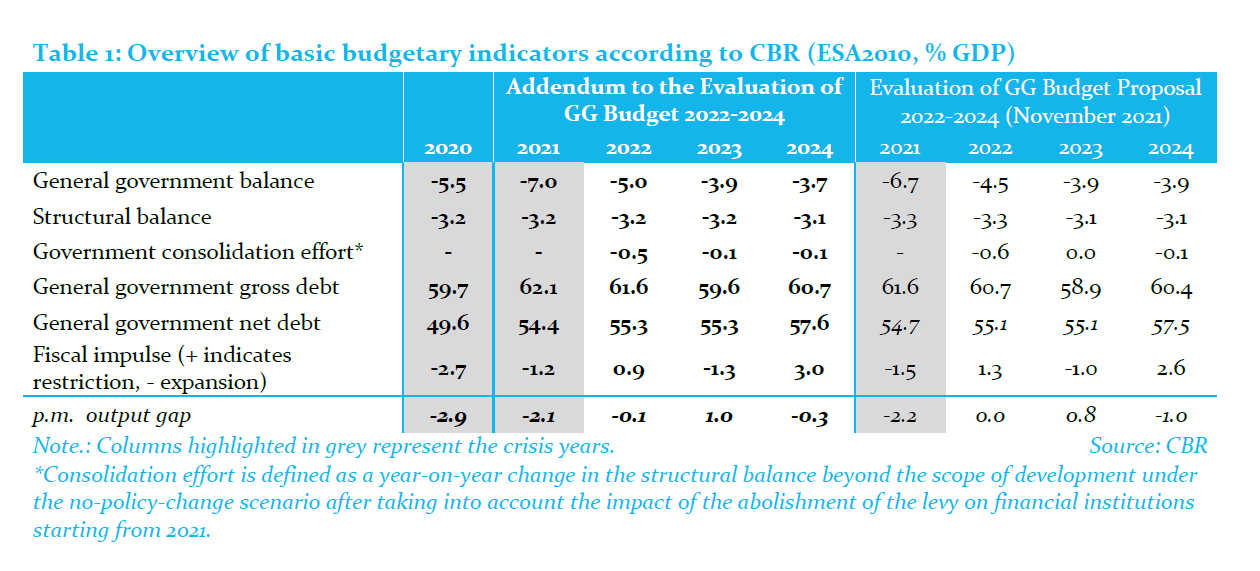

Taking into account the changes in comparison with the government’s proposal, the Council assesses the budget approved by the parliament as realistic in 2022 as well. However, the positive risks for 2022 are absent when taking into account the most recent developments; following the update, the deficit estimate of the Council has practically increased to a level of some 5.0% of GDP[1] that is on par with the Finance Ministry’s target, in particular due to a worse development of the pandemic. The fact remains that, in 2023 and 2024, there are no specific and credible measures facilitating the fulfilment of targets set by the government. According to the Council’s estimate, the specified measures would help reduce the deficit only to 3.9% of GDP in 2023 and 3.7% of GDP in 2024, instead of 3.4% and, respectively, 3.3% of GDP.

The CBR increased the deficit estimate in 2021 to 7.0% of GDP based on updated assumptions regarding the development of public finances and additionally adopted measures (such as signature of collective agreements increasing the wages in the public sector in 2021 and 2022, introduction of the vaccination bonus for senior citizens) which have partly been reflected in the subsequent years as well. The higher deficits assumed at the beginning of the horizon in comparison with the forecast presented in the evaluation of the budget proposal[2] are also due to the higher expenditure on addressing the pandemic because of the negative developments of the epidemiological situation.

The worsened deficit estimate has also been reflected in a slight rise in the estimated debt increase when the gross debt is expected to reach 60.7% of GDP at the end of 2024[3]. The adjusted estimate of fiscal performance has not resulted in changes in the long-term sustainability risk. According to the CBR’s forecast, the budget in combination with the approval of the pension reform based on the requirements under the Recovery and Resilience Plan could reduce the currently high sustainability risk, but only down to the threshold between the medium and high-risk zone, while the long-term sustainability indicator itself would reach 4,9% of GDP. The Council points to the fact that the general government budget itself is deteriorating the long-term sustainability by 0.5% of GDP.

No significant changes in the assumed consolidation effort have been made in the approved budget; according to the CBR’s estimate, the 2022 budget itself (not taking into account fiscal reforms) means slackening the consolidation effort by 0.5% of GDP[4]. This naturally complicates the fulfilment of objectives for the following years 2023 and 2024 and defers the stabilisation of the debt. Without adopting additional consolidation measures, the year 2023 would see a procyclical expansion because the significant inflow of European funds would increase the availability of public funding at a time when overheating of the economy is foreseen. If the improved development of the budget in 2021 is confirmed, the government should consider an adequate reduction in such slackening despite the attenuating effect on the economy. In order to reduce the deficit below 3% of GDP and bring the long-term sustainability risks safely to the medium-risk zone by the end of the parliamentary term, the government should undertake the necessary additional consolidation of 1% to 1.5% of GDP. If the reforms attached to easing the deficit to 4.9% in 2022 are not approved, the government should reduce the deficit to 4% of GDP in order to compensate for unapproved reforms.

If a more negative macroeconomic development persists as a result of the pandemic, the government should continue to support the economy through effective and targeted one-off incentives and by increasing the current investments that will not pose a burden on the long-term sustainability (e.g. by accelerating the draw-down of European funds or by transferring future public investments into the present).

The Council has repeatedly noted that the existing legislative framework governing the budget approval procedure in the parliament does not fit the scope and content of the documents that are being approved. The approval of a cash-based state budget by the parliament for the next year is based on a historical tradition, but is no longer sufficient to capture the key monitored parameters of public finances and all changes in public finances in accordance with the European standards defined by the ESA2010 methodology.

The legislative change approved by the parliament with regard to the financing of church and private school facilities has not been incorporated in the budget. It involves an increase in transfers for these entities, while the additional funds will have to be provided by municipalities and self-governing regions from their own budgets. However, the expected increase in expenditure was not reflected in the budget through an increase in budgeted expenditures of local governments. At the same time, this change was not accompanied by any quantification of impacts on public finances or by a specific proposal for covering the increased expenditure.

The manner in which the wage rise is implemented for a large group of public sector employees poses a risk for the future. For 2022, the deadline for the indexation of salaries has been extended from 1 January to 1 July; at the same time, the payment of a special bonus was agreed in 2021. Both these steps will unburden public finances in 2022 (in comparison with standard indexation as from 1 January), however, according to the Council, they may (if the wage process returns to the original setup) increase the baseline level of wage expenditure for collective bargaining in the public sector in the upcoming years. Repeating this approach could also make the evaluation of the budget less transparent in terms of development in the structural balance and adjusted expenditure.

Find the complete Addendum below.

[1] The CBR’s estimate amounts to 4.95% of GDP vs. Finance Ministry’s target at 4.94% of GDP:

[2] In the evaluation of the budget proposal, the CBR estimated the general government deficit at 6.7% of GDP in 2021, 4.5% of GDP in 2022 and 3.9% of GDP both in 2023 and 2024.

[3] In the CBR’s evaluation of the budget proposal in November 2020, the gross debt was estimated at 60.4% of GDP at the end of 2024.

[4] The CBR quantifies the “consolidation effort” by comparing the structural balance development against the NPC scenario. This gives a more accurate picture of the “size of measures” de facto adopted by the government through the budget. The Ministry of Finance, as well as the EC, calculate “consolidation” as a year-on-year change in the structural balance. Even though this approach is an internationally accepted standard, it is simplified in that it assumes no year-on-year changes in the structural balance, as long as the government adopts no additional measures. According to the Ministry of Finance, the structural balance will improve by 0.2% of GDP in 2022 (unchanged under the CBR’s scenario). Historically, during regular economic times in Slovakia, the structural balance has been improving by some 0.2 p. p. of GDP year-on-year, provided that the government is not taking any active measures except on the basis of how the existing applicable legislation is set (such as indexation of certain expenditure). The macroeconomic parameters expected for 2022 imply that the structural balance would improve by as much as 0.4% of GDP under the NPC scenario.