Main conclusions and recommendations

- The budget aggravates the long-term sustainability

- The budget was not prepared in accordance with expenditure ceilings

- Therefore, it lacks permanent measures to reduce the deficit from expected 5.7% of GDP to 5.2% of GDP this year

- A growing tax and social contribution burden narrows the space for the consolidation of revenues in the future

The general government budget for 2024 to 2026 is the first budget submitted by the government that formed after the parliamentary election of September 2023. Due to the late date of the parliamentary election and the government’s decision to adopt the budget by the end of the year, the draft budget was approved by the government on 12 December 2023. Subsequently, the National Council of the Slovak Republic (the parliament) approved an act on the state budget on 21 December 2023.

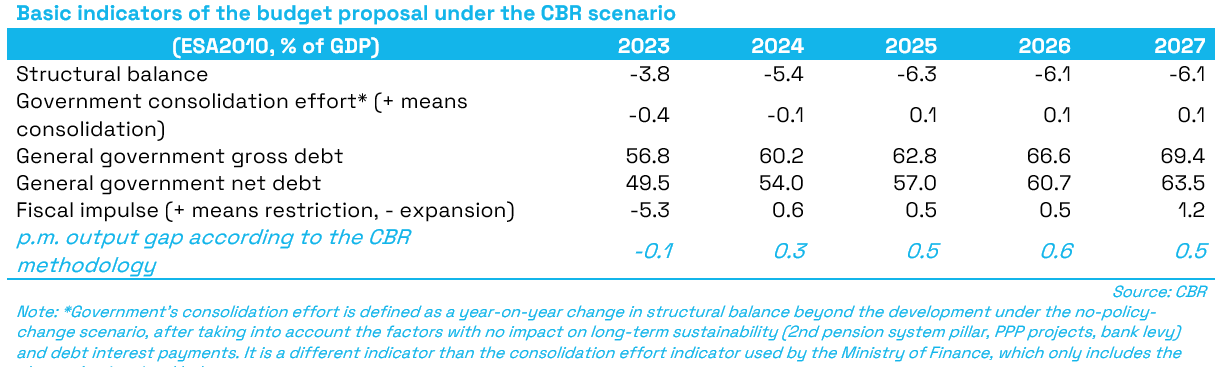

Objectively speaking, the current cabinet took over the management of public finances in a complicated situation after two crises, which means that in the absence of government measures, the deficit would oscillate around 6% of GDP in the 2024-2027 period, with Slovakia’s debt gradually growing up to a 70% of GDP level. The long-term sustainability of public finances is now in a high-risk zone. According to the Council’s estimates, the bad situation in public finances was mainly affected by the security and economic crisis and the pandemic, an initial high structural deficit at the end of the “good” economic times, and the measures adopted in 2023. The two latter causes resulted also from non-application (or suspended application, as of 2023) of expenditure ceilings as a key tool for fiscal governance and improving long-term sustainability.

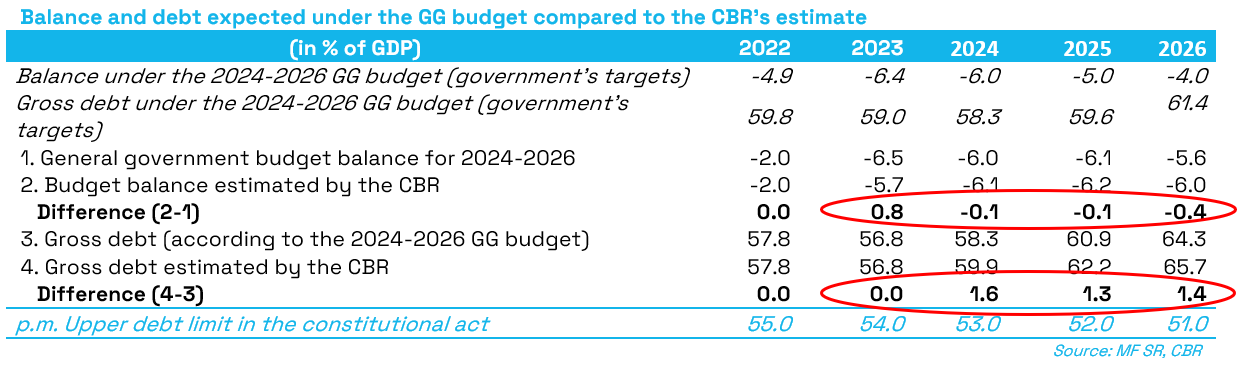

Compared to the 2023 general government deficit originally expected at the level of 6.4% of GDP, the government currently estimates its size at 6.5% of GDP. The budget proposal expects the deficit to improve to 6,0% of GDP year-on-year in 2024. The approved budget expects a gradual decrease in deficit towards the level of 5.6% of GDP by 2026. The government intends to achieve a general government deficit of 5.0% of GDP in 2024 and, subsequently, 4.0% of GDP in 2026, but has yet not prepared any measures for those years.

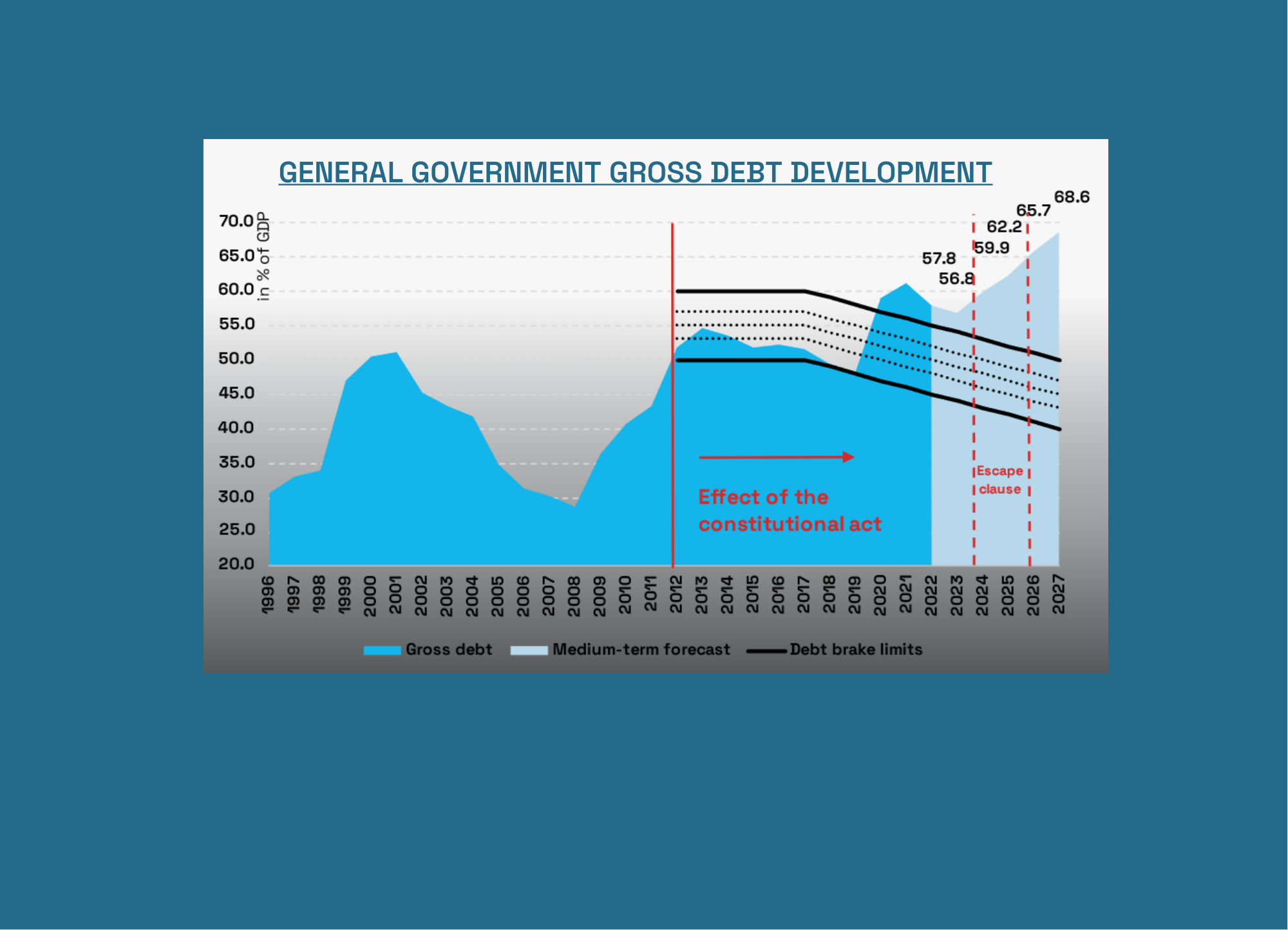

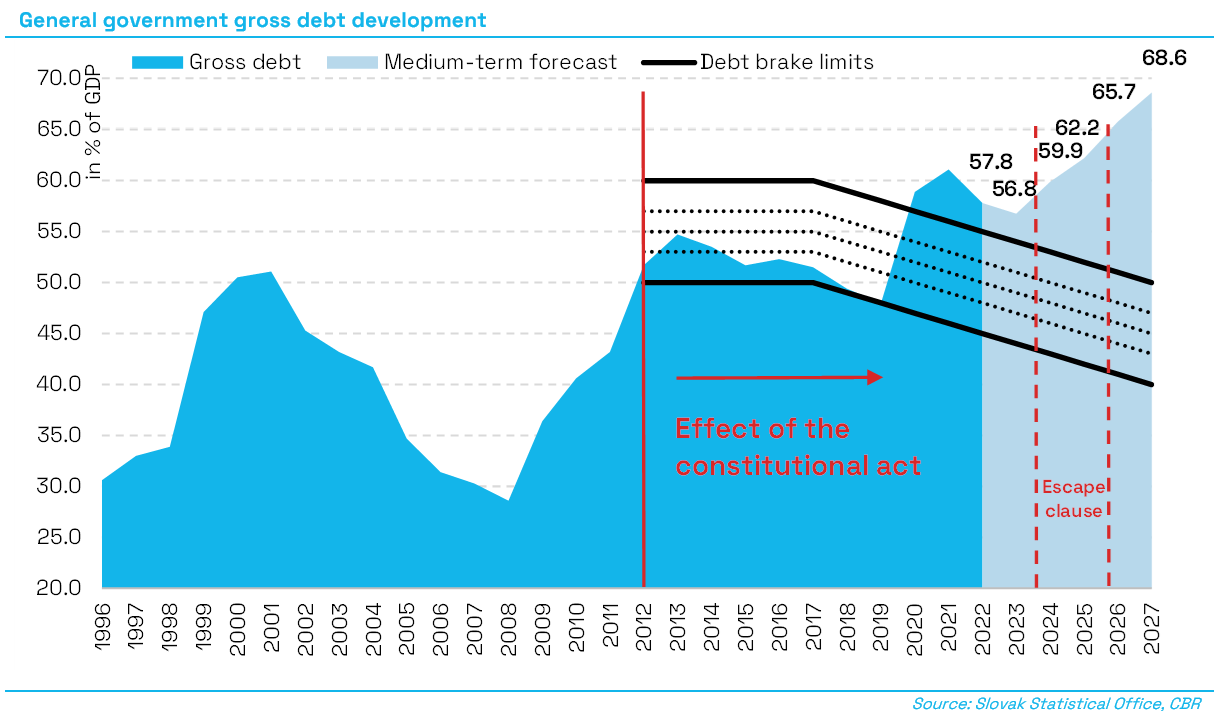

The government believes that the budget will reduce the gross debt from 57.8% of GDP in 2022 to 56.8% of GDP in 2023, after which it will gradually increase towards 61.4% of GDP at the end of 2026, assuming that budgetary objectives, not supported by any measures, will be met. The increase is mainly driven by the high levels of deficits expected in the near term. Regardless of the expected development, the debt has since 2020 been above the upper limit of the sanction brackets under the constitutional act and, according to the Ministry of Finance, will remain above this limit throughout the forecast period, as well.

The budget proposal was not prepared in accordance with expenditure ceilings, since the government claims that there were no ceilings in force at the time when the budget was prepared and approved. According to the CBR, the ceilings approved by the parliament on 1 February 2023 remain in force until the parliament approves new ones; the CBR, therefore, prepared a comparison of the budget against public expenditure ceilings.

On 15 December 2023, the CBR submitted to the parliament the public expenditure ceilings to be applied through the 2024-2027 period, calculated on the basis of the legislative framework at the beginning of the term of the new government, to fairly reflect the legislative situation at the time when the government’s manifesto had been approved. If approved by the parliament, the 2024-2027 ceilings would replace the currently applicable ceilings of February 2023, however, the new ceilings have not been discussed and approved by the parliament to this date.

To compare them with the approved budget, the Council prepared a preliminary calculation[1] of how the expenditure ceilings would have looked like taking into account all legislative changes adopted by the parliament in December 2023, affecting the revenues or the long-term sustainability of public finances. Adjusted for those measures, the approved general government budget exceeds the expenditure ceilings by 1.7 bn euros in 2024 and by 2.2 bn and 2.0 bn euros in 2025 and 2026, respectively[2]. Since the expenditure ceilings require that the long-term sustainability annually improves by 0.5% of GDP and the Ministry of Finance itself acknowledges that the sustainability is not improving, the budget cannot be considered to be in line with the expenditure ceilings. The budget derogating from the ceiling in 2024 means that the budgetary expenditures to which the expenditure ceilings apply have a negative effect on the long-term sustainability amounting to as much as 0.8% of GDP.

It means that the 2024-2026 general government budget was not prepared in accordance with the expenditure ceilings[3] and the budget lacking the expenditure ceilings was approved by the parliament. Therefore, the budget does not comply with the provisions of §30aa(8) of Act No. 523/2004 on general government budgetary rules, under which the government has an obligation to align a general government budget proposal with the applicable expenditure ceiling. Since expenditure ceilings are a key fiscal tool to achieve the long-term sustainability of public finances, their omission from the budget may represent a breach of both Article 55a of the Constitution of the Slovak Republic, under which the Slovak Republic is bound to protect the long-term sustainability of its fiscal performance, and Article 7(3) of constitutional Act No. 493/2011, which establishes the requirement to set expenditure ceilings not only as a formal but rather as an essential tool to be applied in the budgeting process[4].

The purpose of the CBR’s opinions is to offer an independent view on the budget and assess whether the fiscal policy setup is sufficient in terms of achieving the targets set and, at the same time, to identify potential risks which need to be eliminated through the adoption of additional measures. In line with its mandate, the CBR also assesses whether the current budget creates conditions to ensure the long-term sustainability of public finances and to comply with national fiscal rules. To that end, the CBR wishes to highlight the following key conclusions from its evaluation:

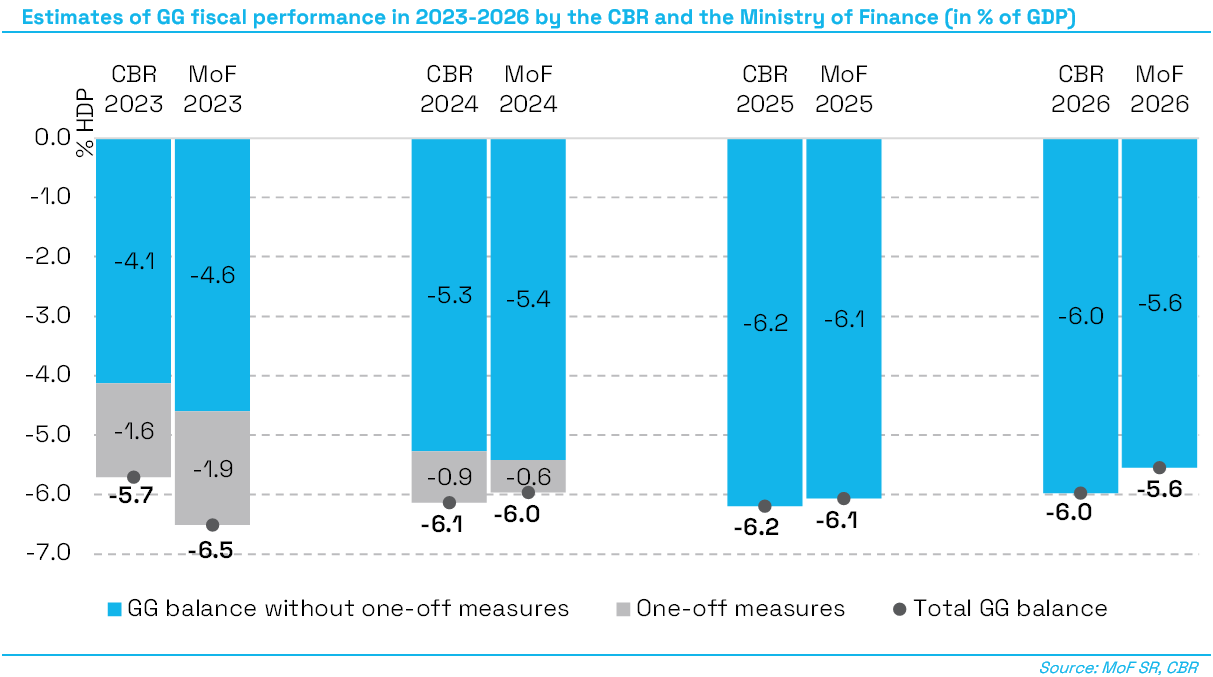

- The baseline year for the preparation of the 2024-2026 general government budget is 2023. Based on the most recent information, including the cash balance of the state budget, the Council believes that the 2023 deficit may amount to 5.7% of GDP only. This represents a considerably better starting position (by 0.8% of GDP) for the 2024-2026 period than as currently estimated by the government. The positive deviation mainly results from not including the full amount of EU refunds for energy compensations in the government’s estimate, as well as from overestimating the state budget’s capital expenditures compared to the actual development.

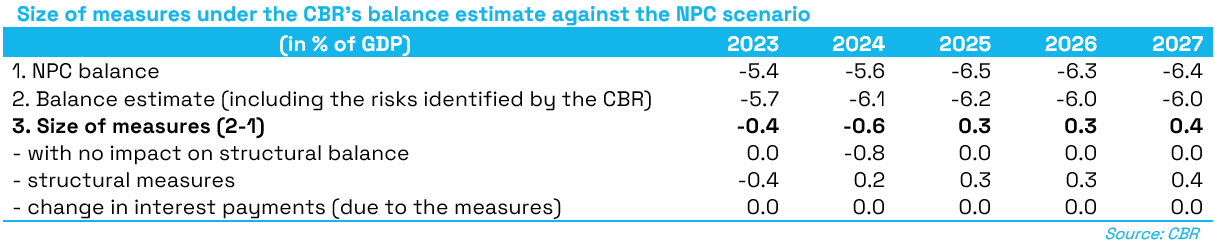

- Under a no-policy change scenario (without new measures approved by the government formed after the parliamentary election), the general government deficit would rise from the 2023 level of 5.4% of GDP to 5.6% of GDP in 2024, followed by a more significant increase in the range of 6.3% to 6.5% of GDP over the 2025-2027 period. Viewed by individual years, the effect of high inflation on public finances is shifting since, unlike revenues, a large portion of expenditures responds to the growth in nominal economy with a delay. At the same time, the development in public finances is also negatively affected by legislative changes adopted in the previous period, which result in higher general government expenditures throughout the entire budgetary horizon[5].

- According to the Council’s estimate, the 2024 deficit can reach 6.1% of GDP, only 0.1% of GDP more than as included in the budget, with both negative and positive risks identified in its structure. However, unlike the government which expects the deficit to decrease5% of GDP year-on-year, the CBR, by contrast, anticipates an increase of 0.4% of GDP once the energy subsidies are correctly accounted for. From this point of view, the government’s plan to reduce the deficit by 0.5% of GDP year-on-year without additional measures cannot be considered realistic. If the budget was to comply with the expenditure ceilings, permanent measures would need to be implemented in order to reduce the deficit from 5.7% of GDP expected for 2023 to 5.2% of GDP this year.

- The reserve for compensation measures in connection with growing energy prices earmarked in the budget represents 800mn euros and is insufficient to cover the approved compensation schemes in 2024 as their costs are expected to exceed 1.25 bn euros. The budget assumed that the additional expenditures would be refunded under the EU’s Supporting Affordable Energy (SAFE) scheme, but, according to the ESA2010 methodology, this positive effect is most likely to be included in the fiscal results for 2023[6]. Taking into account this effect, the CBR estimates the size of one-off measures in the deficit to be by 0.3% of GDP higher in 2024.

- Compared to the 2024 budget, the CBR forecasts the size of the deficit excluding one-off measures to be 0.1% of GDP smaller. This positive deviation mainly results from lower expected budgetary spending, where the CBR does not expect that the full volume of budgetary reserves will be used and has also identified savings in defence expenditures. The CBR also expects lower expenditure on social benefit payments, mainly parental allowances. On the other hand, the Council has identified negative risks for the budget deficit in tax revenues and healthcare expenditure.

- In the upcoming years, the Council estimates a reduction in deficit to 6.2% of GDP in 2025, and 6.0% of GDP in 2026 and 2027. In 2026, the estimate is 0.4% higher than the budget deficit expected by the Ministry of Finance, therefore, the budget prepared in that year cannot be considered realistic. Furthermore, assessed against the declared targets, the government lacks specific measures in the amount of 1.2% of GDP in 2025 and 2.0% of GDP in 2025.

- According to the CBR’s estimate, the permanent measures increase the deficit by 0.3% of GDP cumulatively over the 2023-2027 period, in particular due to measures that increase expenditures on a permanent basis. They mainly include the introduction of 13th pension payments, higher healthcare expenditure, higher expenditures in connection with the establishment of a new ministry, as well as the envisaged spending of the legislative reserve earmarked for new government policies. These should be partially offset by the revenue-side measures (higher excise tax rates, introduction of tax licences, the permanent part of the reinstated bank levy), as well as by cuts in investments by local government expected by the CBR amid their existing unfavourable financial condition (with an effect of 0.2% of GDP). Accordingly, the general government budget alone contributes 0.5% of GDP to the permanent deterioration of the deficit.

- Based on its medium-term fiscal forecast, the Council has calculated the amount of expenditures to which the public expenditure ceilings apply, looking into how the government would meet the ceiling under its estimate. If the development in public finance was in line with the CBR’s scenario, the consolidation measures necessary to meet the public expenditure ceilings would amount to 1.2 bn euros in 2024, gradually growing to as much as 3.1 bn euros in 2027. Compared to the size of consolidation measures implied by the budget, their size included in the CBR’s estimate is nearly 500mn euros lower in 2024 and, on the other hand, almost 850 mil euros higher in 2026. There are no major differences between the CBR’s and the Ministry of Finance’s estimates for 2025. The difference in the 2024 estimate is primarily driven by lower estimated defence expenditures, expected underspending of a part of funds in the budgetary reserve, and lower projected expenditures on parental allowance. The situation will reverse in the subsequent years due to the lack of indexation of expenditures by the Ministry of Finance.

- If the public expenditure ceilings were met in 2024 to 2027, the deficit would decrease to 3.7% of GDP in 2027 and the gross debt would be 6.4 p.p. lower than currently estimated by the CBR, at the level of 62.2% of GDP at the end of 2027. Said deficit level would not suffice to stabilise the debt-to-GDP ratio.

- Based on the estimated development in general government balance, the CBR expects the gross debt-to-GDP ratio to have fallen to 56.8% of GDP in 2023. Following a year-on-year reduction in the gross debt relative to GDP in 2022 and 2023, mainly due to high inflation, the general government gross debt will rise in the medium term to as much as 68.6% of GDP at the end of 2027, according to the CBR. With respect to the gradual decrease in the thresholds of sanction brackets, this would mean that the debt remains high above the upper limit of debt brake, exceeding the limit by nearly 19 p.p. in 2027.

- Net debt would reach 49.5% of GDP at the end of 2023. If the CBR’s assumptions concerning a gradual medium-term decrease in the state’s cash reserve to a historical average from the pre-crisis period are met, the net debt would increase to an all-time high at 62.7% of GDP at the end of 2027.

- According to the CBR’s estimate, the approved general government budget contributes 0.2% of GDP to the deterioration of the long-term sustainability indicator. The negative contribution of the government’s measures is even higher, at 0.5% of GDP. One of the reasons is that a substantial part of the approved measures improves the medium-term balance only temporarily and will be followed by a deterioration in the public finances over a long-term horizon. The estimated 0.2% of GDP decline in the long-term sustainability indicator for the whole of general government compared to the government’s contribution follows from the CBR’s assumption concerning investment cuts by local governments due to their current unfavourable financial position. Since the expenditure ceilings require the government to improve the sustainability by 0.5% of GDP each year, the failure to comply with the ceilings means that the government will contribute as much as 1% of GDP (0.5% + 0.5%) to the decline in the sustainability indicator, which corresponds with the aforementioned need for additional measures worth 1.2 bn euros.

- The CBR estimates that the fiscal expansion have achieved the level of 5.3% of GDP in 2023, driven mainly by significantly accelerated spending of EU funds due to the end of the third programming period. According to the Council, the estimated notable decline in the spending of EU funds in the medium term will result in the restrictive setting of the fiscal policy, despite the increase in the structural deficit which contributes to fiscal expansion. Since the economy will run slightly above its potential in the medium term, stronger consolidation efforts above the development currently estimated by the CBR would have no significant impact on economic imbalances; quite to the contrary, intensified consolidation efforts would be desirable given the current condition and development in public finances. From the perspective of macroeconomic effects of fiscal policy, it is therefore necessary that the inevitable consolidation of public finances be accompanied by as intensive spending of EU funds as possible.

- The Council considers compliance with the expenditure ceilings to be the absolute minimum necessary for the recovery of public finances and budgetary objectives should respect this, as well. If the ceilings were complied with, the budget deficit targets would be 5.2% of GDP in 2024, 4.5% of GDP in 2025, and 3.9% of GDP in 2026. However, the current deficit targets are higher by 0.8% of GDP in 2024, 0.5% of GDP in 2025, and 0.1% of GDP in 2026. Given the unfavourable development in public finances and the crisis period coming to an end, the Council does consider the deterioration of public finances in 2024 as projected in the budget and the postponement of the necessary consolidation efforts to a later period to be justified. According to the CBR, the main medium-term objective of the government, until 2026, should be to stabilise the debt by reducing the deficit to a level close to the 3% of GDP limit and bringing the long-term sustainability indicator from the high to the medium risk zone.

- At the same time, public finances have not improved despite the rise in taxes and social contributions. This naturally narrows the room for the necessary consolidation on the revenue side in the future. The Council wishes to emphasise and requests that, in line with efforts to promote the long-term competitiveness of the Slovak Republic, taking into account the requirement of economic and social justice and solidarity between present and future generations, all revenue and expenditure measures should be carefully considered and duly justified in the proper legislative process, in accordance with the principles of transparency and efficiency.

In terms of transparency, the CBR does not consider the approved budget to have been prepared in accordance with the budgetary objectives for 2024 to 2025. According to the government, the 2024 budget target will also be met by reimbursing part of the energy subsidies from EU funds, which is very likely to be in conflict with ESA2010 principles. No specific consolidation measures are planned for the coming years.

[1] CBR, Predbežný výpočet aktualizácie limitu verejných výdavkov (Preliminary calculation of updated public expenditure ceilings), December 2023. In its evaluation of the general government budget, the CBR takes into account the expenditure ceilings that would apply if all legislative procedures were followed (approval by the parliament of the calculated expenditure ceilings of 15 December 2023 and their updating to reflect the current legislative framework).

[2] Compared to the expenditure ceilings approved by the parliament in February 2023, which the CBR believes are still valid, the approved general government budget exceeds the ceilings by 5 billion euros in 2024 and 5.9 billion euros in 2025. The main reason for these significant deviations is that the ceilings were calculated at the end of 2022 (based on the legislative framework in force at that time) and, therefore, must be adjusted for the negative effects of the measures adopted during 2023.

[3] See Chapter 7.

[4] See Chapter 7.

[5] More detailed calculation of individual factors is available here.

[6] Commission Opinion on the Draft Budgetary Plan of Slovakia for 2024, page 4.