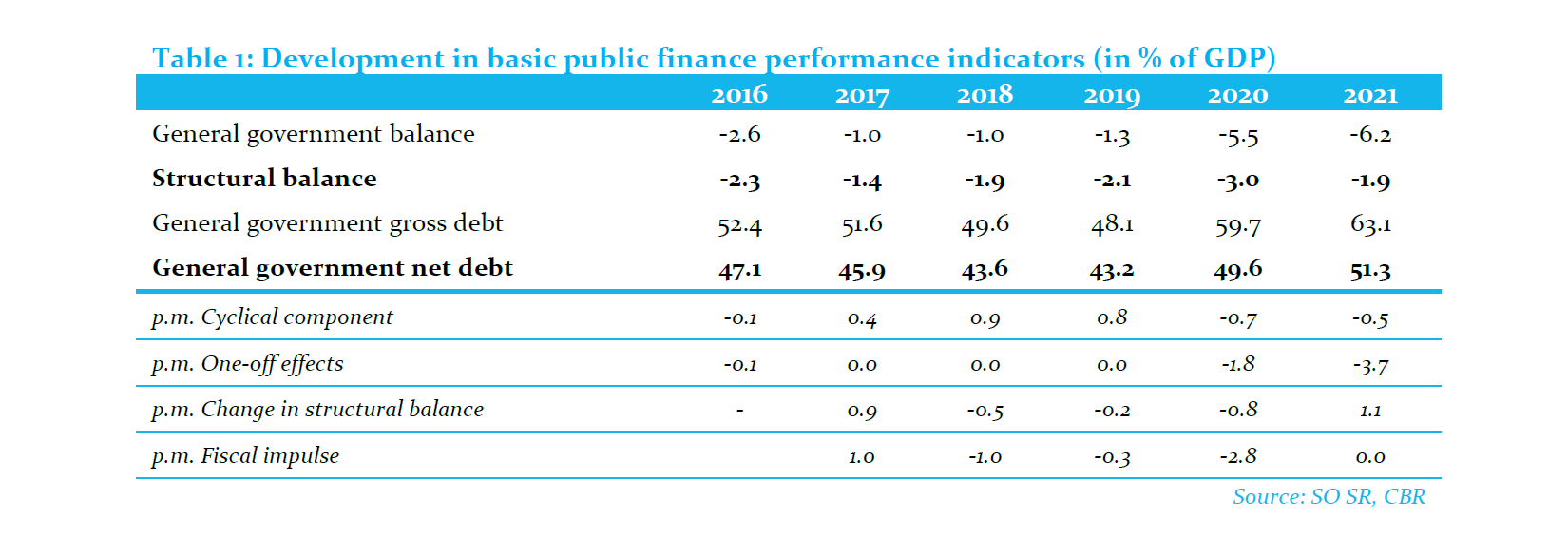

In 2021, the general government (GG) deficit reached 6.2% of GDP, a significant improvement in comparison with the target set in the approved budget at 7.4% of GDP. A positive deviation from the budgetary objective, by 1.2% of GDP, means the most remarkable improvement since 2005. Gross debt reached 63.1% of GDP, which is 1.9% of GDP below the budgeted forecast.

The preparation of the budget for 2021, as well as subsequent developments in public finances, was marked by a significant uncertainty due to the ongoing COVID-19 pandemic. The worsened epidemiological situation necessitated the repeated introduction of measures restrictive for the economy, as well as higher spending aimed at bolstering the economy and funding the costs of testing and vaccination. On the other hand, even thanks to the support measures of the government, economy was recovering faster in comparison with the initial conservative estimates.

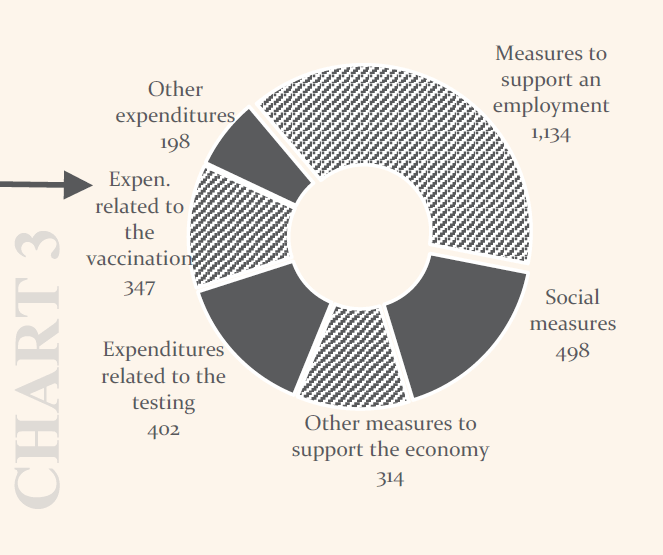

In the fiscal performance of the general government in 2021, the most significant deviations from the budgetary assumptions were directly related to the uncertainty associated with the pandemic situation. On the upside, revenue from taxes and social security contributions increased by EUR 1.9 billion (1.9% of GDP), in particular due to higher-than-expected tax revenues in 2020 which directly translated into an increase in revenue in 2021. On the downside, the general government deficit was influenced by higher expenditure for measures aimed at addressing the pandemic, thus increasing the budget deficit by EUR 1,9 billion (1.9% of GDP) after taking the reserve into account.

Other factors not directly related to the pandemic situation have also significantly contributed to the deviation of the final result from the budgetary target. Unspent capital expenditures of the state budget reflected in a reduction by EUR 0.8 billion (0.8% of GDP); a positive effect amounting to EUR 0.6 billion (0.6% of GDP) can be attributed to better-than-expected fiscal performance of local governments and other general government entities. On the other hand, the payment of the transfer to the EU budget which was not paid between 2012 and 2019, including the late-payment interest (the “Chinese customs duty” case) increased the general government deficit by EUR 0.5 billion (0.5% of GDP).